- 🐝 The Investing Show

- Posts

- TEL

TEL

When "Mission-Critical" Actually Means Something

"Boring" Business About to Electrify The World

Why the company connecting the AI revolution might be hiding in plain sight

Some investors call TE Connectivity boring. I call it brilliantly positioned. While everyone chases the next flashy AI chipmaker, this $67 billion connector company is quietly becoming the arterial system of the digital economy—and management just committed to accelerating growth after nearly a decade of consistent compounding.

At its first investor day in eight years, TE's leadership made a bold promise: through-cycle revenue growth of 6-8% annually (up from 4% historically), EPS expansion of at least 10% per year, and a doubling of its AI business within two years. For a company that has tripled both EPS and dividends over the past 12 years, this isn't hype—it's an operational machine shifting into higher gear.

When "Mission-Critical" Actually Means Something

TE Connectivity designs and manufactures connectors and sensors that enable data, power, and signal transmission across virtually every industry: AI data centers, electric vehicles, aerospace, defense, energy grids, and factory automation. These aren't commodity products you can swap out easily. Management describes their business as "super sticky" because customers co-design solutions two to three product generations into the future.

Consider the numbers: TE has 10,700 engineers currently collaborating on 5,000 different product designs with customers globally. In 2026 alone, they'll add another 1,000 co-design arrangements. This isn't a transactional relationship—it's an embedded partnership model where TE's products become integral to their customers' architectures.

The value proposition centers on reliability in harsh environments. As one executive noted during investor day, their customers' systems simply cannot fail—whether on the ocean floor, in space, or inside an AI server rack running at extreme temperatures. This mission-critical positioning creates pricing power and switching costs that competitors struggle to replicate.

The AI Opportunity Is Bigger Than You Think

TE's cloud and AI business generated $1.4 billion in fiscal 2025 and is projected to exceed $3 billion by 2027—a more than doubling in two years. Yet I suspect this guidance is conservative.

Here's why: hyperscaler CapEx has tripled in three years, but TE's content per AI chip has grown 5x over the same period. As AI server racks evolve from 50 kilowatts (NVIDIA H100) to 120 kilowatts (GB200) to 600 kilowatts (Rubin, expected 2026) and eventually toward 1 megawatt by 2030, the number of power and signal connections per rack multiplies accordingly.

TE currently commands a 30% market share in AI interconnect—and expects this share to grow. The company delivered $900 million in revenue last year from products that didn't exist two years prior. That's not incremental innovation; it's a business model built for rapid technological evolution.

Management highlighted three competitive vectors in AI: design complexity, pace of innovation, and manufacturing scalability. Few competitors can execute on all three simultaneously. TE's ability to iterate alongside customers without a fixed design spec—while simultaneously ramping global manufacturing capacity—creates what they call a "next level" competitive advantage.

The Second Energy Revolution

Beyond AI, TE is positioned at the intersection of the largest energy infrastructure buildout in 70 years. Management frames this starkly: the world will need to replicate the energy capacity built over the last seven decades within the next three—while simultaneously replacing half of aging grid infrastructure.

Demand is coming from multiple angles: EV adoption (particularly in Asia and Europe), factory automation, electrification of everything, and the voracious power requirements of AI itself. TE's content per vehicle at BYD has increased 10x from $5 to $50. Content per factory robot has grown from $60 to $100.

These aren't one-time wins. As vehicles, factories, and infrastructure become more data-intensive and electrically complex, TE's addressable content expands structurally.

Financial Quality That Compounds

The fiscal 2025 results speak for themselves: record revenue of $17.3 billion (up 9%), record adjusted EPS of $8.76, and $4.1 billion in operating cash flow with free cash flow conversion exceeding 100%. Adjusted operating margins hit 20% in the fourth quarter, up from 18.6% a year earlier.

Balance sheet strength remains solid. Net debt-to-EBITDA sits at a comfortable 0.8x, and interest coverage is extraordinarily strong at roughly 70x EBIT. The debt/equity ratio of approximately 0.45 provides ample flexibility for opportunistic M&A without straining the capital structure.

Management's capital allocation framework is disciplined: one-third of free cash flow goes toward a growing dividend, with the remainder split between share repurchases and acquisitions based on expected ROIC. The company targets mid-teens returns on invested capital—currently running around 12% but with clear pathway to improvement through margin expansion and disciplined deal-making.

The dividend has been increased for 14 consecutive years, most recently by 9%. Combined with consistent buybacks (shares outstanding down 3.2% year-over-year), TE delivers meaningful capital returns while maintaining investment firepower.

What The Market Is Missing

At $226.9 per share (approximately 26x trailing earnings), TE isn't cheap in absolute terms. But context matters. The implied growth rate embedded in current prices—roughly 6-7% EPS growth over the next five years using a reverse DCF—sits below management's own 10%+ commitment.

If TE delivers even the low end of guidance, today's buyers are effectively getting the AI and energy inflection for free. If management executes above guidance (as they historically have), the upside could be substantial.

The real question isn't whether TE Connectivity is boring. It's whether investors recognize that "boring" businesses connecting transformational technologies often deliver extraordinary long-term returns.

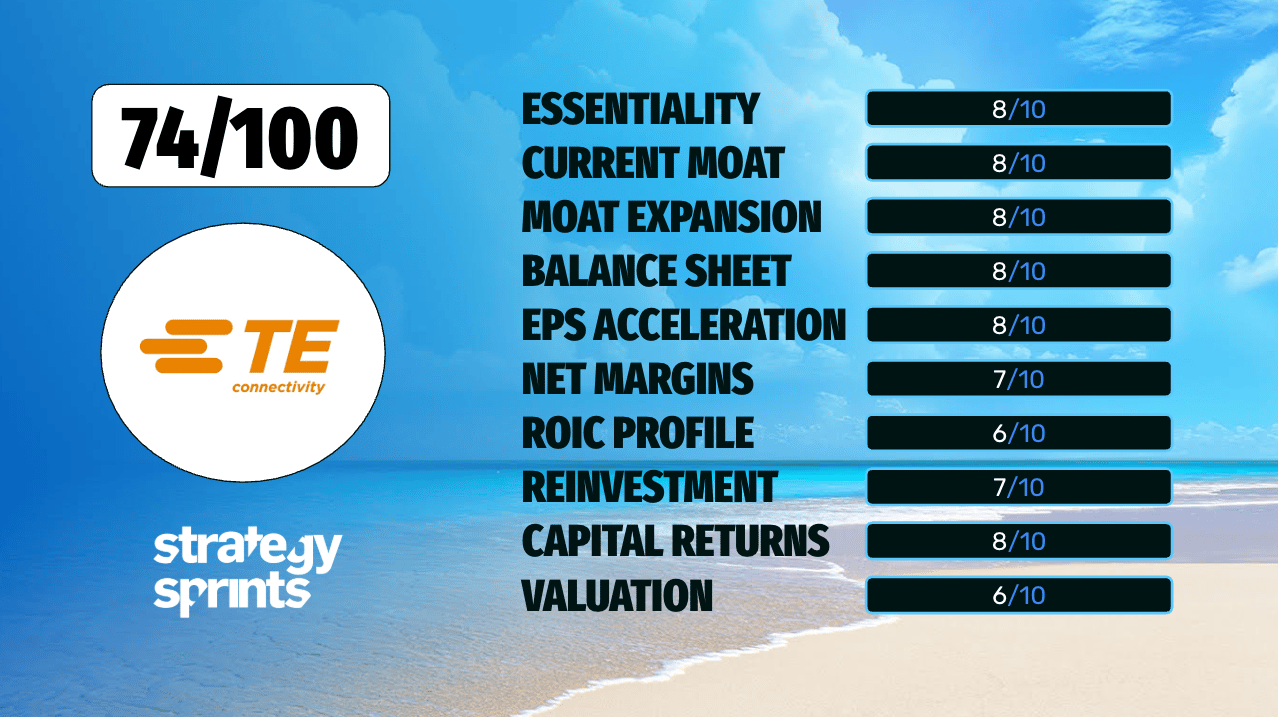

Let’s Score TEL

Criterion | Rating | Notes |

|---|---|---|

Essential vs. Nice-to-Have | 8/10 | Mission-critical connectors for AI, energy, transportation—hard to substitute |

Current Moats | 8/10 | Co-design relationships, engineering depth (10,700 engineers), global manufacturing at scale |

Moats Expanding? | 8/10 | AI content growth 5x, new co-design arrangements accelerating, capacity doubling |

Balance Sheet Strength | 8/10 | Net debt/EBITDA 0.8x, 70x interest coverage, ample flexibility |

EPS Accelerating? | 8/10 | FY25 EPS +16%, management targeting 10%+ CAGR going forward |

Net Margins Increasing? | 7/10 | Adjusted operating margin expanding ~60bps annually toward 20%+ |

ROIC Profile | 6/10 | ~12% currently, targeting mid-teens—solid but room to improve |

Reinvestment Rate | 7/10 | Meaningful CapEx for capacity expansion; M&A active with ROIC discipline |

Capital Returns | 8/10 | 14 consecutive dividend increases, consistent buybacks, ~$2.2B returned FY25 |

Valuation | 6/10 | ~26x P/E implies ~6-7% growth; management guiding 10%+, decent risk/reward |

Overall Score: 74/100

A high-quality industrial compounder at the intersection of AI and energy megatrends, with disciplined management, expanding moats, and accelerating growth—fairly valued with upside if execution continues.

Right now it sits on my watchlist, which you can access in real-time in our community.

Would you like to stay ahead of opportunities like this? Join our community where we share real-time trade alerts and deep-dive analyses of businesses with true competitive advantages. Don't just trade the market - invest in excellence.

Want to receive our trade alerts and detailed analysis in real-time? Join our community of value investors who understand that pricing power is the ultimate competitive advantage. Receive our trade alerts on your phone? Download the app here

|