- 🐝 The Investing Show

- Posts

- SHOP

SHOP

The Silent Kingmaker of AI Agents

At $186.4, is the market sleeping on commerce's most important infrastructure play?

The $1 Trillion Question Nobody's Asking

While investors debate Shopify's e-commerce growth, they're missing a bigger story: the company has quietly built the infrastructure that AI shopping agents will need to buy things across the internet.

McKinsey projects AI agent-driven commerce reaching $1 trillion in US retail by 2030. Shopify already has partnerships live with ChatGPT, Perplexity, and Microsoft Copilot. Every Shopify store became "agent-ready by default" as of Winter 2025. With 200+ million Shop Pay users and 27% revenue growth, Shopify has transformed from website builder into critical AI infrastructure—yet few investors fully appreciate this shift.

Why Merchants Can't Leave (Even If They Wanted To)

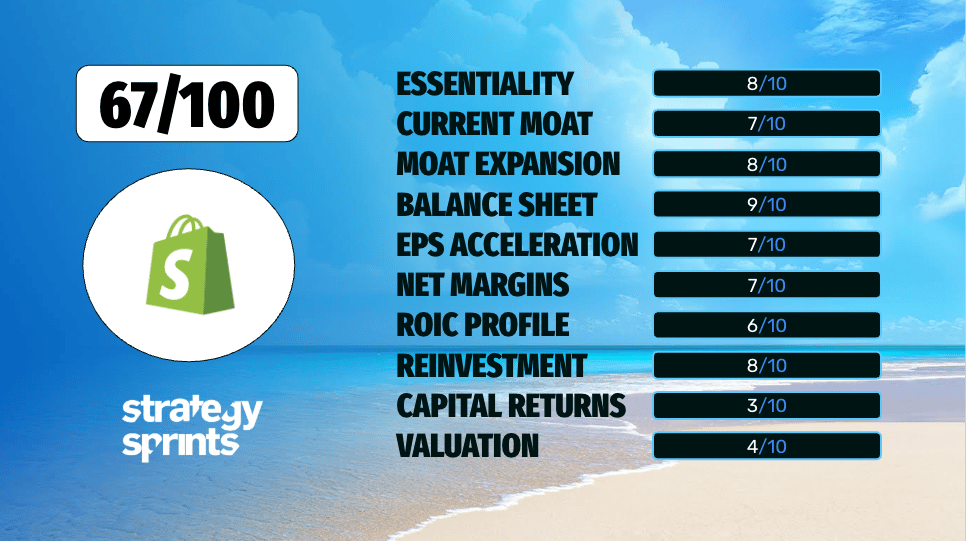

Essentiality Rating: 8/10

Shopify's customer retention exceeds 90%, and here's why: switching has become nearly impossible. Merchants build dependencies across 8,000+ third-party apps, from email marketing to inventory management. Shopify Payments now processes 64% of all GMV—migration means reconstructing every payment flow, transaction history, and reconciliation system.

The financial hooks run deeper. Shopify Capital has originated $5.1 billion in merchant financing since 2016, with $805 million in Q1 2025 alone. Merchants receiving Capital average 36% higher sales. Repayment occurs through daily sales percentages, creating dependency that competitors can't easily break.

The Moat That Keeps Getting Wider

Current Moat: 7/10 | Moat Expansion: 8/10

Shop Pay represents Shopify's most underappreciated competitive advantage. With 200+ million global users and conversion rates 50% higher than guest checkout, it creates consumer-side lock-in unusual for a B2B platform. Users are 77% more likely to make repeat purchases, creating a self-reinforcing flywheel.

Against competitors, Shopify occupies unique positioning: unlike Amazon (which captures buyer loyalty while commoditizing sellers), Shopify lets merchants own their brand and customer relationships. Unlike WooCommerce (which requires technical expertise), Shopify provides turnkey infrastructure. The 8,000+ app ecosystem dwarfs BigCommerce's ~1,200.

Two growth vectors are accelerating the moat:

B2B commerce is Shopify's fastest-growing segment—GMV up 109% year-over-year in Q1 2025, marking six consecutive quarters of 100%+ growth. The global B2B e-commerce market reaches $19-32 trillion (3x consumer), with enterprise wins including VF Corp, Kering Beauty, and Starbucks.

Agentic commerce may prove transformational. Shopify has built the complete infrastructure stack: a Catalog API giving AI agents access to hundreds of millions of products, Universal Cart holding items across multiple merchants, and Checkout Kit integrating Shop Pay's high-converting checkout with compliance across 170+ countries. Unlike Amazon—which blocked Google's shopping bot—Shopify's open API approach positions it as neutral infrastructure all AI agents can utilize.

The Numbers Behind the Story

Balance Sheet: 9/10 (Fortress)

Shopify maintains $6.35 billion in cash and short-term investments against just $1.12 billion in debt—a $5.91 billion net cash position that grew 57% year-over-year. This fortress balance sheet provides optionality for strategic M&A without financial stress.

EPS Acceleration: 7/10

The earnings trajectory demonstrates powerful operating leverage. After a -$2.73 loss in 2022, Shopify delivered $0.10 EPS in 2023 and $1.55 in 2024—a 1,450% improvement. Q1 2025 non-GAAP EPS reached $0.25, up 25% year-over-year. Operating expenses compressed from 51% of revenue in Q1 2023 to 36% in Q1 2025.

Margins: 7/10

Free cash flow margin hit 15% in Q1 2025, marking seven consecutive quarters of double-digit FCF margins. The company generated $363 million in FCF during the quarter, up from $290 million year-over-year. Management guides toward 20%+ FCF margins as operating leverage continues.

ROIC: 6/10

Return on invested capital has improved 63% year-over-year to approximately 19-21%, roughly matching Shopify's elevated cost of capital. The trajectory matters more than the level—ROIC should expand as profitability matures and the stock's 2.82 beta eventually compresses.

Reinvestment: 8/10

Shopify spends $1.5 billion annually on R&D (~15% of revenue) while generating substantial free cash flow—an unusual combination. After divesting the logistics business to Flexport in 2023 (ending what CEO Tobi Lütke called a "side quest"), the company refocused on high-ROIC software development. The recent Vantage Discovery AI acquisition and hire of Microsoft's former Copilot lead as CTO signal AI as the primary investment vector.

Capital Return: 3/10

Shopify pays no dividend and runs no buyback program. Given 27% revenue growth and the emerging agentic commerce opportunity, reinvestment generates higher returns than distributions would. Investors seeking income should look elsewhere.

The Price You Pay

Valuation: 4/10

At $186.4, Shopify trades at ~137x trailing earnings and 22.6x sales—demanding multiples that price in significant execution. Reverse DCF analysis suggests the market expects ~23-25% revenue CAGR for five years with FCF margins expanding to 22-25%.

The stock trades above most analyst price targets ($159-180 consensus), limiting near-term upside absent growth acceleration. However, valuation analysis may underweight agentic commerce optionality. If Shopify captures even 10-15% of McKinsey's projected $1 trillion AI commerce opportunity, current pricing significantly undervalues the business.

Overall Score: 67/100

Shopify represents a high-quality compounder with expanding moats and unique positioning for agentic commerce. The 67/100 score reflects a strong business trading at a premium that limits near-term upside but may undervalue long-term AI infrastructure optionality.

The bull case: If AI shopping agents become the dominant purchase interface, Shopify's open API approach—versus Amazon's walled garden—positions it as the neutral checkout layer. Q1 2025 results ($2.36B revenue up 27%, $74.75B GMV up 23%) demonstrate execution remains strong while agentic infrastructure develops.

The bear case: At 137x earnings and 0.78% FCF yield, any growth deceleration would pressure the multiple significantly. The 2.82 beta amplifies volatility in both directions.

For patient investors comfortable with premium valuations, Shopify offers exposure to potentially the most important shift in e-commerce since mobile: the transition from search-based to agent-based shopping. The thesis requires conviction, but the company building the checkout button every AI agent will click may prove worth the price.

The business quality is undeniable. The valuation requires conviction. Right now it sits on my watchlist, which you can access in real-time in our community.

Would you like to stay ahead of opportunities like this? Join our community where we share real-time trade alerts and deep-dive analyses of businesses with true competitive advantages. Don't just trade the market - invest in excellence.

Want to receive our trade alerts and detailed analysis in real-time? Join our community of value investors who understand that pricing power is the ultimate competitive advantage. Receive our trade alerts on your phone? Download the app here

|