- 🐝 The Investing Show

- Posts

- Q4 2025 Letter to Our Partners

Q4 2025 Letter to Our Partners

Performance Review of 2025: Overall CAGR 16%

Dear Partners,

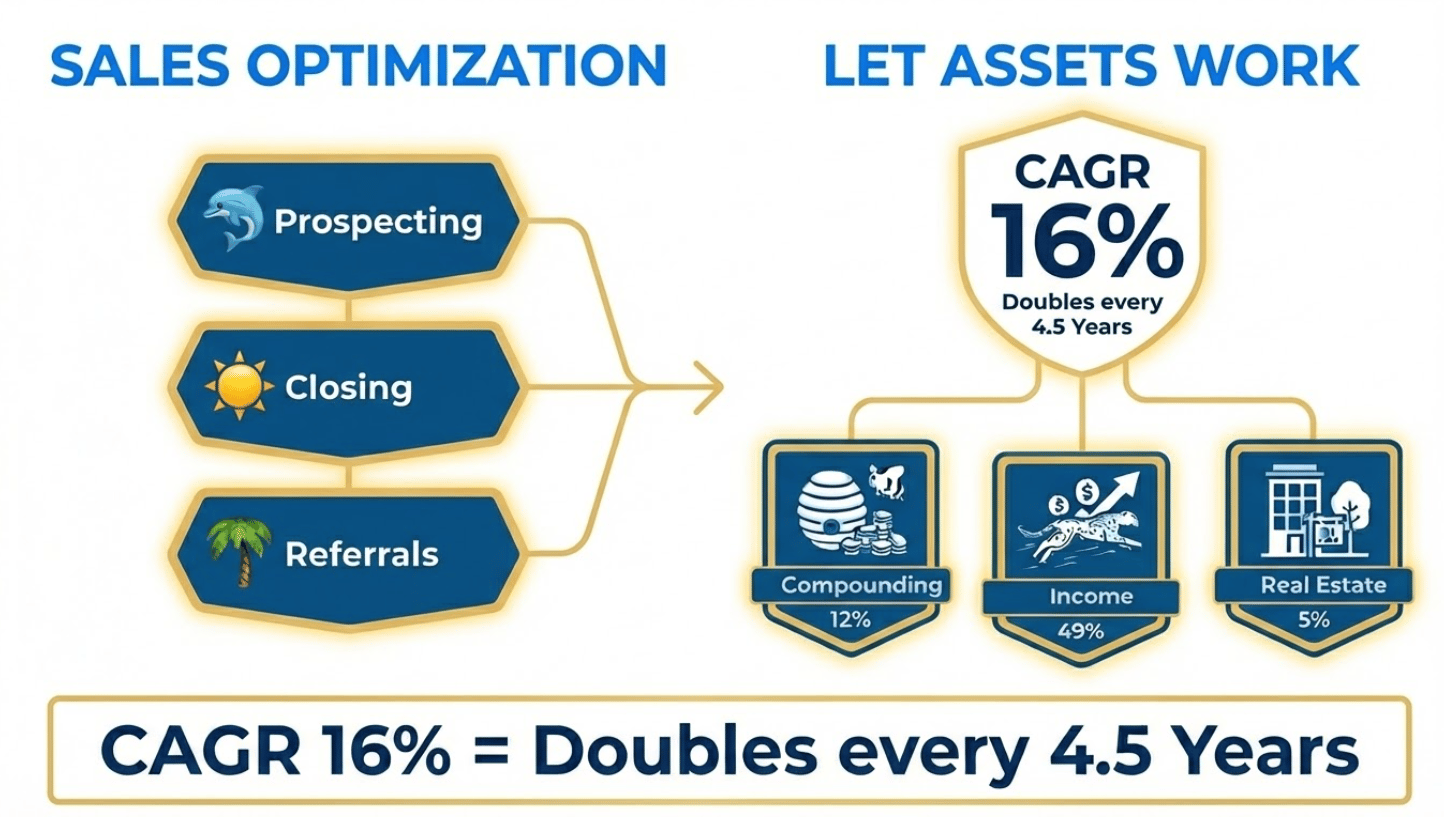

Let’s review Q4 2025 and the overall annual performance in order to learn as much as we can. The overall performance is 16% CAGR which means we are on track. Even if we made some mistakes along the way. At this pace, we will double our assets worth every 4.5 years in a repeatable, risk-adjusted way. That is exactly the job of our overall portfolio. To increase our assets’ value over decades, while securing that we never become forced sellers at any point along the way. The key measurement each quarter will not be “does it beat the market” but “does it compound our wealth”. This quarter the answer is “Yes”.

Key Learnings:

Overall strategy validated, even with one portfolio underperforming

Surprise of the year: Futures Options are a massive contributor

Top performers: ANET and APP

Repeatability and discipline drive results (embrace the “boring”)

COMPOUNDING PORTFOLIO

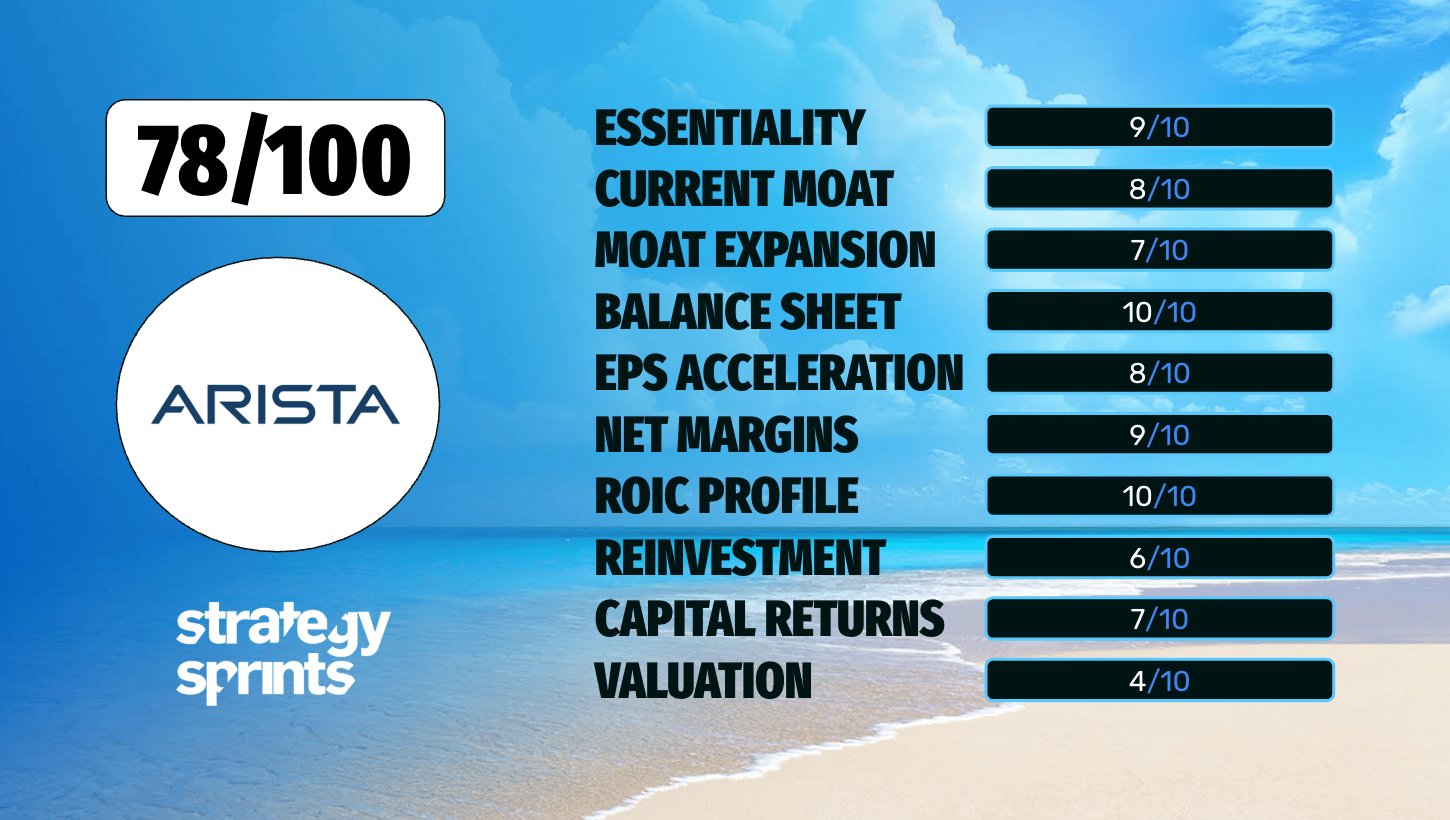

Nine companies with sustainable competitive advantages, strong management teams, and high reinvestment rates. Top contributors this year: ANET and APP.

Performance (11.9%) trailed the S&P 500 (14.8%). The strategy: own fewer than 10 companies with large position sizes. True to this principle, 55% of the portfolio sits in just three companies—serious concentration. Below, I review their performance and our plan for the coming months.

INCOME PORTFOLIO

This one surprised me most. I was skeptical and documented every trade. It didn't just survive the scrutiny—it proved resilient, repeatable, and cash-generative, delivering 49% performance.

Our community helped many partners stay grounded and disciplined through massive volatility. I shared my pre-trade plan daily and will continue doing so. Many members are fund managers who've run hedge funds or portfolios for decades, which elevates the quality of our interactions. One member was even voted "Fund Manager of the Year."

REAL ESTATE PORTFOLIO

Low expectations of 5% were met. This portfolio serves one purpose: stability. It's completely passive by design—an asset, not a liability. Apartments are small (52–56 sqm), in top locations near infrastructure. Asset managers maintain occupancy above 92–93%.

Now let’s dive into each position, and what we plan to do in the coming months. This section is for paid subscribers, become one of them to access all positions, trading plans and planned portfolio moves.