- 🐝 The Investing Show

- Posts

- Nu Holdings

Nu Holdings

The Hidden Pricing Power of Playing Tennis against Grandma.

Many of you asked in our community, “Simon why don’t you buy MELI?” In my view MELI is playing tennis against grandma (Lending) and it is playing tennis against Nadal (Ecommerce). The last thing I want to do is to compete against Amazon. Ask your local books dealer. NU is playing tennis against grandma. In a region where traditional banks have long enjoyed oligopolistic positions, Nu Holdings has flipped the script. But here's what most analysts miss: Nu's true pricing power doesn't come from charging more - it comes from charging less while making more.

The Most Efficient Bank on The Planet

Operating expenses of $624.8M fell from $634.0M in Q2 and increased from $503.3M in Q3 2023.

Been working with banks a lot in the last 21 years, and these are the best metrics I have seen at any bank, anywhere, ever. These numbers are the envy of modern finance. And NU as achieved it under harsh market conditions in a country that’s badly managed. Imagine their performance if Brasil stabilizes.

The Cost Advantage Moat

Nu's pricing power stems from an extraordinary cost structure that traditional banks can't match:

Customer acquisition cost of just $7 (industry's lowest)

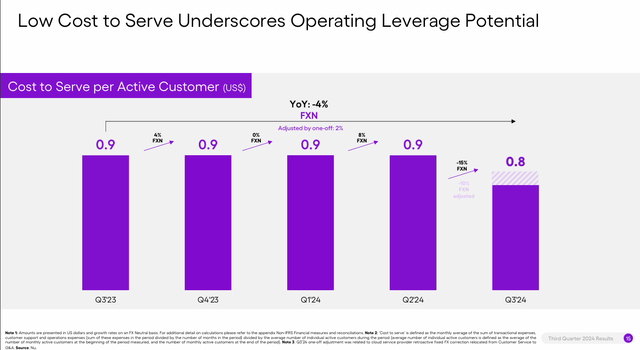

Service cost of $1 per customer (85% below competitors)

Credit risk 15% below market average

Funding costs at 87% of interbank rates

This creates a fascinating paradox: Nu can charge lower prices while maintaining higher margins than traditional banks.

The Revenue Expansion Story

What makes Nu particularly interesting is their ability to expand revenue per customer without raising prices:

Revenue per customer has grown from $3 to $11 in just three years

Mature customers generate $25+ in revenue

Monthly churn rate of just 0.2%

61% of customers use Nu as their primary bank

Traditional banks in Latin America have historically operated like a cartel, maintaining high fees and interest rates. Nu's approach is different:

Start with lower rates to acquire customers

Build trust through transparency

Cross-sell higher-margin products

Leverage data for precision pricing

The Network Effect Multiplier

Nu's pricing power strengthens with scale:

110 million active customers create massive data advantages

30,000+ data points per active customer monthly

Network effects drive 84% activity rates

Customer referrals lower acquisition costs further

Looking Ahead

Nu's pricing power is likely to increase as:

The customer base matures (higher revenue per user)

Product penetration deepens

Operating leverage improves

Data advantages compound

For investors, Nu's pricing power isn't about charging premium prices - it's about sustainably undercutting competitors while maintaining superior profitability. This is the kind of pricing power that disrupts markets permanently. Nu is on top of my watchlist right now. Access my complete watchlist in our community.

Would you like to stay ahead of opportunities like this? Join our community where we share real-time trade alerts and deep-dive analyses of businesses with true competitive advantages. Don't just trade the market - invest in excellence.

Want to receive our trade alerts and detailed analysis in real-time? Join our community of value investors who understand that pricing power is the ultimate competitive advantage. Receive our trade alerts on your phone? Download the app here