- 🐝 The Investing Show

- Posts

- NOW

NOW

The platform 85% of Fortune 500 can't quit

The platform 85% of Fortune 500 can't quit

ServiceNow has evolved from a humble IT ticketing system into the digital nervous system of the Fortune 500, commanding a 44.4% market share in IT service management while growing revenues at 20%+ annually. At $1,771 per share, investors are paying a significant premium for what Morningstar calls a "wide moat" business—but the company's 98% renewal rates, AI-driven expansion, and fortress balance sheet suggest the premium may be justified for long-term holders willing to accept near-term valuation risk.

ServiceNow's products sit squarely in the "mission critical" category. When 85% of Fortune 500 companies depend on your platform to manage everything from IT incidents to HR workflows to customer service operations, you've transcended software to become infrastructure.

The stickiness metrics tell the story: 98-99% renewal rates and approximately 125% net revenue retention mean customers not only stay but spend progressively more each year. The average enterprise implementation involves 10+ integrations across departments, creating what one analyst called "organizational muscle memory" that's extraordinarily painful to unlearn. Companies that started spending $100,000 in 2010 now spend over $2.6 million annually—a 26x expansion that reveals the depth of platform dependency.

Essentiality Rating: 9/10 — Near-infrastructure status for enterprise operations.

A moat that keeps getting deeper

ServiceNow's competitive advantages derive primarily from switching costs so severe that migration projects are measured in years, not months. The typical 12-18 month implementation creates layers of customized workflows, trained employees, and integrated systems that would require wholesale reconstruction elsewhere.

The company has deployed AI strategically to widen this moat further. Now Assist, ServiceNow's generative AI suite, surpassed $200 million in annual contract value within 15 months of launch—the fastest product ramp in company history. The Pro Plus SKU commands a 60% price premium over standard offerings, and management projects Now Assist will reach $1 billion ACV by 2026.

Market dominance provides additional protection: ServiceNow controls 44.4% of the ITSM market, more than five times the share of its nearest competitor. The partner ecosystem of Accenture, Deloitte, and IBM drives over 50% of implementations, creating a flywheel that competitors struggle to replicate.

Current Moats Rating: 9/10 — Wide moat with multiple reinforcing sources.

Moat Expansion Rating: 8/10 — AI initiatives actively strengthening competitive position.

Financials that would make a CFO blush

The balance sheet is a fortress. ServiceNow holds $6.1 billion in cash against just $1.5 billion in debt, producing a comfortable net cash position that provides strategic flexibility for acquisitions or weathering downturns.

Recent results demonstrate continued execution at scale. Q1 2025 delivered $3.09 billion in revenue (up 19% year-over-year), while current remaining performance obligations of $10.31 billion provide exceptional visibility into future revenue. Free cash flow reached $3.4 billion in 2024, growing 26% annually with margins around 31%—remarkable for a company reinvesting heavily in AI and global expansion.

Profitability has improved dramatically. GAAP operating margins expanded from 4.4% in 2020 to approximately 13% in 2024, while non-GAAP operating margins now exceed 30%. Net margins followed a similar trajectory, rising from the low single digits to nearly 13%.

Balance Sheet Rating: 9/10 — Fortress with substantial net cash position.

Net Margin Trend Rating: 8/10 — Rapid expansion from minimal base to double digits.

Growth engine firing, but not accelerating

EPS growth remains solid without achieving hypergrowth status. Non-GAAP EPS of $4.04 in Q1 2025 represented 18.5% year-over-year growth, and analysts project full-year 2025 EPS of $9.32, approximately 29% above 2024 levels. The trajectory is healthy but reflects a maturing business rather than an accelerating one.

Return on invested capital hovers around 16-17%, comfortably above cost of capital but not exceptional by software standards. The company's decision to prioritize reinvestment over capital returns explains part of this dynamic.

EPS Acceleration Rating: 7/10 — Steady double-digit growth, not explosive acceleration.

ROIC Rating: 7/10 — Solid returns exceeding 15%, room for expansion.

Capital allocation favors growth over shareholders

ServiceNow launched its first-ever buyback program in 2023, authorizing $4.5 billion in total repurchases. However, the program primarily offsets dilution from stock-based compensation rather than shrinking the share count meaningfully. SBC runs approximately 16% of revenue, and net dilution persists around 1% annually.

No dividend exists, nor should investors expect one soon. Management channels cash toward R&D (23% of revenue) and strategic acquisitions—over 30 completed to date. Recent moves include a $2.85 billion acquisition of Moveworks for AI agent capabilities and rumored talks for cybersecurity firm Armis at $7 billion.

Reinvestment Rate Rating: 9/10 — Aggressive R&D and M&A investment for growth.

Capital Return Rating: 5/10 — Buybacks offset dilution; no dividend.

The valuation question: expensive for a reason?

At $1,771, ServiceNow trades at approximately 43-44x forward earnings and 44x free cash flow—multiples that assume continued excellence. A reverse DCF analysis suggests the market prices in roughly 18-20% annual FCF growth over the next decade to justify current levels.

The EV/Sales ratio of approximately 13x towers above the SaaS sector average of 5-8x, though ServiceNow's combination of 20%+ growth, 31% FCF margins, and 98% retention is genuinely rare. Analysts maintain a consensus "Strong Buy" rating with an average target near $1,150—implying the stock may have gotten ahead of fundamentals in the near term.

For comparison, Salesforce trades at 32-38x earnings with slower growth, while Workday commands 45-60x. ServiceNow's premium reflects justified confidence in execution, but leaves little margin for error.

Valuation Rating: 4/10 — Premium valuation requires flawless execution.

The bottom line on NOW

ServiceNow represents a rare combination of scale, growth, and competitive protection. The company has transformed from IT ticketing vendor to enterprise workflow platform, capturing switching costs that approach infrastructure-level stickiness. AI initiatives through Now Assist provide a visible growth catalyst while simultaneously deepening the moat.

The financials are excellent: fortress balance sheet, expanding margins, and robust free cash flow generation. Management reinvests aggressively but hasn't yet prioritized meaningful shareholder returns beyond dilution management.

The catch is valuation. At current prices, investors are paying for perfection in a market that rarely delivers it. Long-term holders with five-year horizons may find the premium acceptable given ServiceNow's competitive position, but near-term volatility risk is elevated.

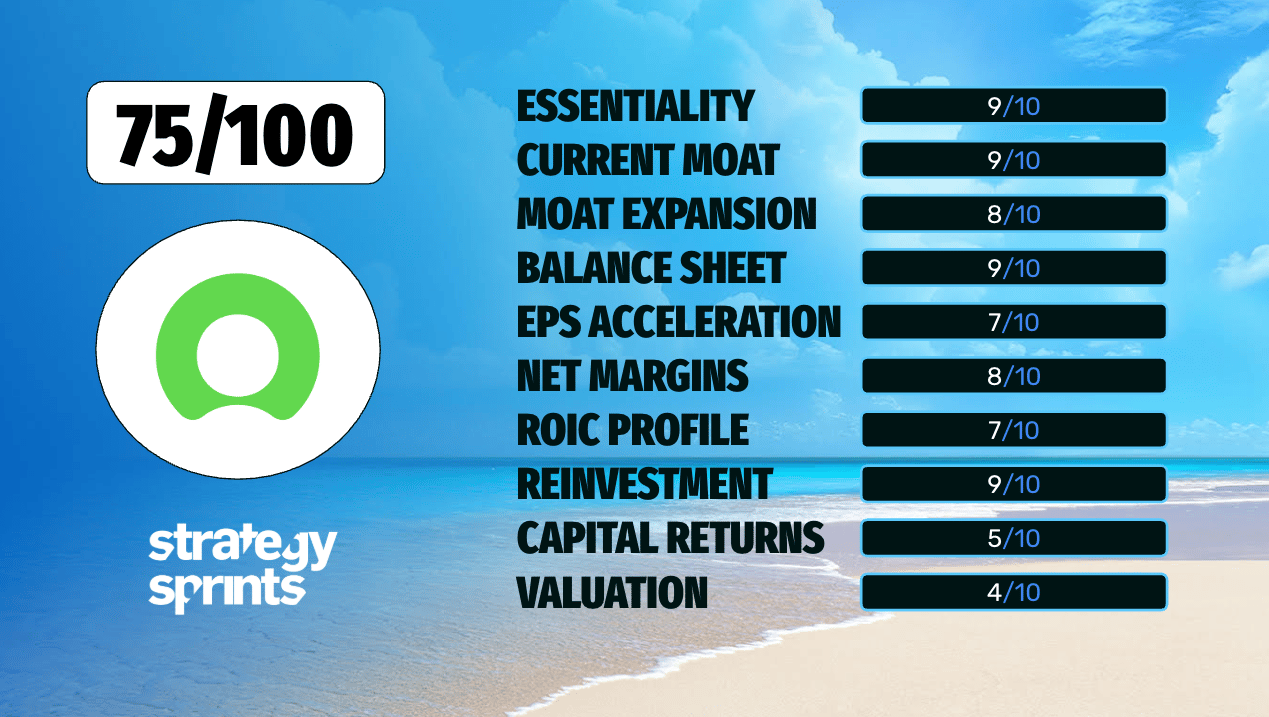

Criteria | Rating |

|---|---|

Essentiality | 9/10 |

Current Moats | 9/10 |

Moat Expansion | 8/10 |

Balance Sheet | 9/10 |

EPS Acceleration | 7/10 |

Net Margin Trend | 8/10 |

ROIC Profile | 7/10 |

Reinvestment Rate | 9/10 |

Capital Return | 5/10 |

Valuation | 4/10 |

Overall Score | 75/100 |

Conclusion

ServiceNow earns a 75/100 overall score. Strong fundamentals constrained by premium pricing. The business quality is undeniable: near-irreplaceable enterprise positioning, AI-driven expansion, and exceptional financial metrics. For investors who can stomach the valuation and maintain a multi-year perspective, ServiceNow remains one of the highest-quality compounders in enterprise software. The ticket to this ride isn't cheap, but the destination may prove worth the price. Right now it sits on my watchlist, which you can access in real-time in our community.

Would you like to stay ahead of opportunities like this? Join our community where we share real-time trade alerts and deep-dive analyses of businesses with true competitive advantages. Don't just trade the market - invest in excellence.

Want to receive our trade alerts and detailed analysis in real-time? Join our community of value investors who understand that pricing power is the ultimate competitive advantage. Receive our trade alerts on your phone? Download the app here

|