- 🐝 The Investing Show

- Posts

- NFLX

NFLX

Why 300 million subscribers make this more than just a couch potato investment

Netflix: The Streaming King Is Binge-Watching Its Own Wallet

Why 300 million subscribers make this more than just a couch potato investment

The streaming wars have been raging for years, but one contender has emerged from the battle looking less like a survivor and more like the last gladiator standing in the Colosseum. Netflix, the company that made "Netflix and chill" part of the English lexicon, has transformed from a DVD-by-mail curiosity into a $408 billion entertainment colossus. But with shares trading at roughly $89 following its November 2025 stock split, and whispers of the Warner Bros Discovery acquisition echoing through Wall Street, the question facing long-term investors is straightforward: Is the red N still a compounding machine worth owning for decades?

Is It Essential or Nice-to-Have?

Here is where entertainment companies typically stumble. Most streaming services fall squarely into the "discretionary spending" bucket, the first expense cut when household budgets tighten. But Netflix has quietly evolved into something closer to a utility.

With over 300 million paid memberships worldwide and an average viewing time of 63 minutes daily per user, Netflix has embedded itself into the nightly routines of households globally. The password-sharing crackdown and ad-supported tier launch in 2022 proved something remarkable: subscribers grumbled, but they did not leave. Instead, they converted. Today, 45% of US Netflix households watch on the ad tier, and more than 55% of new sign-ups in markets where ads are available choose that option.

Netflix sits comfortably between pure necessity and frivolous luxury, closer to the former than most entertainment companies dare dream.

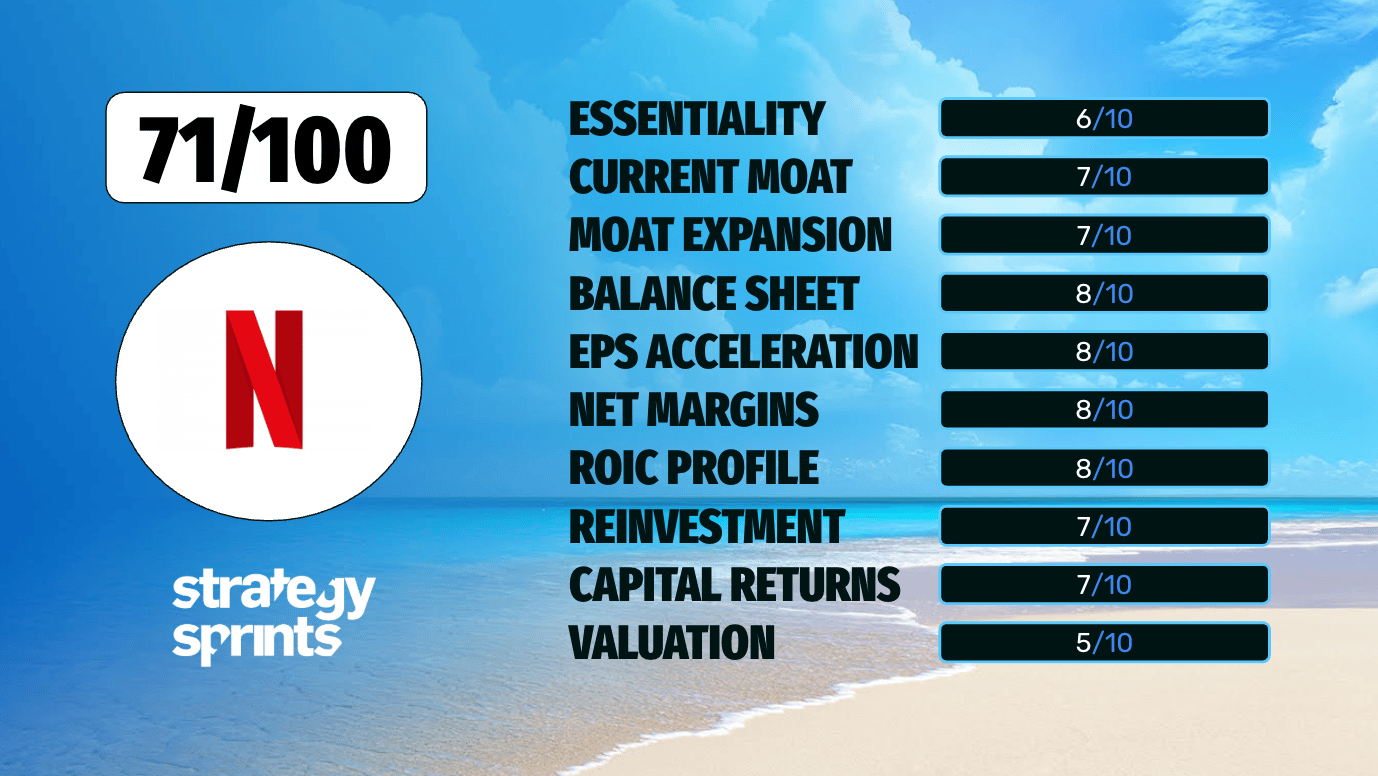

Rating: 6/10

Current Moats

Netflix operates behind a fortress of interlocking competitive advantages. First, there is scale. No competitor comes close to 300 million paying households. This scale creates a virtuous cycle: more revenue funds more content, which attracts more subscribers, which generates more revenue.

Second, Netflix's recommendation algorithm is an underappreciated asset. After years of machine learning trained on billions of viewing hours, the platform knows what you want to watch before you do. This personalization creates switching costs; leaving Netflix means abandoning a finely tuned entertainment concierge.

Third, the company has achieved global content production capabilities unmatched in the industry. From Korean thrillers like Squid Game to Spanish dramas and German crime series, Netflix speaks every language. Competitors struggle to replicate this international content machine.

However, the moat is not impenetrable. YouTube commands 12.6% of US TV screen time compared to Netflix's 8.3%. Disney holds irreplaceable franchises. The moat is wide, but the castle faces formidable armies.

Rating: 7/10

Are Moats Expanding?

The most exciting development in Netflix's moat construction is the advertising business. Launched just three years ago, the ad tier now reaches 190 million monthly active viewers globally. The company has built its own proprietary ad-tech stack, reducing reliance on third parties and improving margins. Management expects to double ad revenue in 2025.

Live programming adds another stone to the wall. WWE Raw provides 52 weeks of appointment television. NFL Christmas games drew massive audiences. These events create "must-watch" moments that streaming catalogs alone cannot replicate.

The proposed Warner Bros Discovery acquisition would bring HBO's prestige library, Harry Potter, DC Universe, and Lord of the Rings under one roof. If completed, this transforms Netflix from a streaming leader into a true entertainment conglomerate.

Rating: 7/10

Balance Sheet Strength

Netflix has traveled a long road from the leverage-heavy days of funding content expansion through debt. Today, the picture looks remarkably healthy.

The company holds $14.5 billion in gross debt against $9.3 billion in cash, leaving net debt around $5.2 billion. The debt-to-equity ratio stands at 0.58, down from 1.67 in 2020. The current ratio of 1.34 indicates comfortable liquidity, while the interest coverage ratio of 17.45 suggests Netflix could pay its interest expenses multiple times over.

Free cash flow has turned dramatically positive, with 2025 guidance raised to approximately $9 billion. The company is repurchasing shares aggressively, buying back 1.5 million shares for $1.9 billion in Q3 2025 alone, with $10.1 billion remaining under its authorization.

The Warner Bros acquisition could stress the balance sheet temporarily, but Netflix enters that negotiation from a position of financial strength.

Rating: 8/10

Is EPS Accelerating?

The earnings trajectory tells a compelling story. In 2024, Netflix delivered EPS growth of 65% year-over-year. The trailing twelve-month increase stands at approximately 35%. Over five years, the company has averaged annual EPS growth of 36.4%.

This acceleration stems from multiple sources: subscriber growth, price increases, ad revenue scaling, and operating leverage as content costs spread across a larger base. The password-sharing crackdown alone converted millions of freeloaders into paying customers, boosting revenue with minimal incremental content expense.

Looking ahead, revenue guidance of $44.8-45.2 billion for 2025 represents approximately 15% growth, and operating margin expansion to 29-30% suggests continued earnings momentum.

Rating: 8/10

Are Net Margins Increasing?

The margin expansion at Netflix has been nothing short of remarkable. Net margin reached 22.3% in 2024, up substantially from earlier years. Operating margin has expanded to approximately 29% and management guides to 29.5% on a currency-neutral basis for 2025.

The drivers are structural rather than cyclical. Content amortization spreads across more subscribers. The ad tier generates high-margin incremental revenue. Password-sharing enforcement monetizes previously unpaid usage. International expansion often carries favorable margin profiles once initial content localization is complete.

The margin trajectory suggests Netflix has significant runway before hitting optimization ceilings.

Rating: 8/10

ROIC Profile

Return on invested capital represents the ultimate measure of a company's capital allocation prowess. Netflix delivers convincingly here.

ROIC reached 21.12% in 2024, up from 14.34% in 2023 and representing the highest level since 2021's 17.47%. Trailing twelve-month ROIC has expanded to approximately 22.9%. Critically, this exceeds Netflix's weighted average cost of capital of 11.4-11.9% by a healthy margin of roughly 9-11 percentage points.

This spread indicates Netflix creates genuine economic value with every dollar invested. The upward trend in ROIC, climbing 64.5% over 2020-2024, suggests improving capital efficiency rather than one-time gains.

Rating: 8/10

Reinvestment Rate

Netflix reinvests aggressively in content, projecting $18 billion in content spending for 2025 following $17 billion in 2024. This represents roughly 40% of expected revenue devoted to building the content library.

However, the company has reached scale where not all earnings need reinvestment to drive growth. The ad tier generates revenue on existing content. Price increases monetize the current subscriber base. International markets continue developing without proportional content expense increases.

Netflix sits at an inflection point where reinvestment remains high but increasingly optional rather than existential.

Rating: 7/10

Capital Return

Netflix has evolved into a significant capital returner. Share repurchases totaled $1.9 billion in Q3 2025 alone, with $10.1 billion remaining under authorization. The company does not pay dividends, preferring buybacks that reduce share count and amplify per-share metrics.

Management paused buybacks temporarily to preserve cash for the potential Warner Bros integration, demonstrating financial discipline. Once that transaction closes or collapses, expect capital returns to resume aggressively.

Rating: 7/10

Valuation

Netflix trades at approximately 46 times trailing earnings, elevated relative to historical averages but arguably justified by its growth trajectory and competitive position.

A reverse DCF analysis at current prices implies the market expects mid-teens revenue growth and continued margin expansion for several years. Given management's guidance and recent execution, these assumptions appear reasonable but leave limited margin of safety.

The stock has declined roughly 24% from October 2025 highs, creating a more attractive entry point than recent months. However, the valuation remains full rather than cheap.

Rating: 5/10

Overall Assessment

Netflix has completed a remarkable transformation from growth-at-all-costs streaming pioneer to profitable, cash-generating entertainment leader. The company possesses durable competitive advantages, a strengthening balance sheet, expanding margins, and returns on capital that exceed cost of capital by meaningful margins.

The risks are real but manageable: intense competition from well-funded rivals, execution challenges with the Warner Bros acquisition, and potential economic sensitivity in discretionary entertainment spending.

For long-term compounders, Netflix represents a quality business at a fair price rather than a bargain. The streaming king has earned its crown.

Overall Score: 71/100

The business quality is undeniable. The valuation requires conviction. Right now it sits on my watchlist, which you can access in real-time in our community.

Would you like to stay ahead of opportunities like this? Join our community where we share real-time trade alerts and deep-dive analyses of businesses with true competitive advantages. Don't just trade the market - invest in excellence.

Want to receive our trade alerts and detailed analysis in real-time? Join our community of value investors who understand that pricing power is the ultimate competitive advantage. Receive our trade alerts on your phone? Download the app here

|