- 🐝 The Investing Show

- Posts

- LIN

LIN

Essentail, Durable and Disciplned. Try Living Without Oxygen, Good Luck.

Why Linde Is the Oxygen Mask You Should Put on First

The world's largest industrial gas company trades 23% below its historical valuation while locking in decades of contracted growth. Here's why this "boring" compounder deserves your attention.

Linde represents a rare combination of mission-critical essentiality, structural moats, and disciplined capital allocation that has delivered 12% EPS CAGR over 30+ years. At $416, the stock trades at 27x trailing earnings—23% below its 5-year average P/E of 38x—while maintaining industry-leading profitability with 29.5% operating margins and 25.9% adjusted return on capital. With a $10.4 billion project backlog and 58% tied to clean energy projects, Linde sits at the intersection of defensive infrastructure and energy transition tailwinds.

Try Running a Chip Fab Without Nitrogen. We'll Wait.

Industrial gases are not discretionary purchases—they are operational necessities without which customer facilities literally cannot function. Semiconductor fabs consume 50,000+ cubic meters of nitrogen hourly at 99.9999% purity; any supply disruption immediately halts production worth millions per day. Steel manufacturing physically cannot proceed without oxygen injection, while hydrogen and nitrogen produce 80%+ of global fertilizer.

The consequences of supply disruption are stark: healthcare patients die within minutes without oxygen, semiconductor wafers worth millions are destroyed by trace contamination, and steel plants halt completely. Linde notes that 62% of sales are "defensive" and resilient to cycles. This isn't a company selling discretionary widgets—it's selling the molecules that keep civilization running.

Four Moats That Would Make Buffett Smile

On-site production with take-or-pay contracts locks customers into 15-20 year agreements with minimum purchase requirements and cost pass-through clauses. Once an air separation unit is built at a customer's site, Linde owns and operates it—switching requires years of construction. Morgan Stanley notes that management "maintains stringent backlog criteria with optionality to de-risk investment."

Pipeline networks create permanent moats. Linde operates 450+ air separation units and 150+ HyCO plants globally. Pipelines make supplier switching essentially impossible.

Extreme switching costs in electronics reinforce captivity. Semiconductor fabs require 12-18+ months of requalification when changing suppliers, with contamination risk making switches extremely costly.

Oligopolistic market structure ensures rational competition. The top three players control ~75% of the global market. Decades of consolidation have created an industry focused on returns rather than market share battles.

Backlog Built for the Next Decade

Linde's $10.4 billion project backlog represents the clearest evidence of moat expansion, with 58% tied to clean energy. Morgan Stanley highlights Linde is executing a "$4B project pipeline in the USGC, targeting ammonia" and other clean energy applications.

The semiconductor opportunity is equally compelling. Morgan Stanley notes "gas intensity for semiconductor manufacturing has more than doubled over the past decade." Management has "submitted bids for TSMC's fabs 3, 4, and 5" and the shift from 5nm to 3-2nm nodes requires even more gas. Linde's 45+ year Samsung partnership and expanding TSMC relationship position it at the center of AI infrastructure buildout.

A Balance Sheet Built Like a Bunker

With 1.33x net debt/EBITDA, 26-34x interest coverage, and A/A2 credit ratings, this is a fortress balance sheet. Cash of $4.85 billion and $11.35 billion in available liquidity provide substantial flexibility. Morgan Stanley's DCF values Linde at $515, noting "~$25B of dry powder available to the company."

The Margins Keep Expanding

Linde has delivered seven consecutive quarters of 200+ basis point operating margin expansion. Net margins have expanded from 12.4% in 2022 to 20.2% today—well ahead of Air Liquide (12-13%) and Air Products (~18%). Morgan Stanley confirms management "reaffirmed the integrity of its long-term EPS growth algorithm, emphasizing disciplined pricing and productivity initiatives."

|

Capital Allocation: The Quiet Compounding Machine

Linde returned $7.1 billion to shareholders in 2024. Share repurchases have reduced shares outstanding by 10.4% over five years, with a $17 billion buyback authorization. Morgan Stanley notes buybacks are "positioned as a strategic lever, with management rejecting short-term trading approaches." The 33 consecutive years of dividend increases qualify Linde as a Dividend Aristocrat.

What's Priced In?

At $416, Linde trades at 27x trailing P/E versus a 38x five-year average—a 30% discount to historical norms. Reverse DCF analysis suggests the market prices 4-6% perpetual growth, while analysts project 10% EPS growth through 2027 and management guides for 8-11% excluding currency headwinds.

Morgan Stanley maintains Overweight with a $495 price target, implying 19% upside. Their valuation blends 19x 2025 EBITDA with DCF methodology. The analyst consensus price target of $504-513 reflects 84% buy ratings across Wall Street coverage.

The Scorecard: How Linde Stacks Up

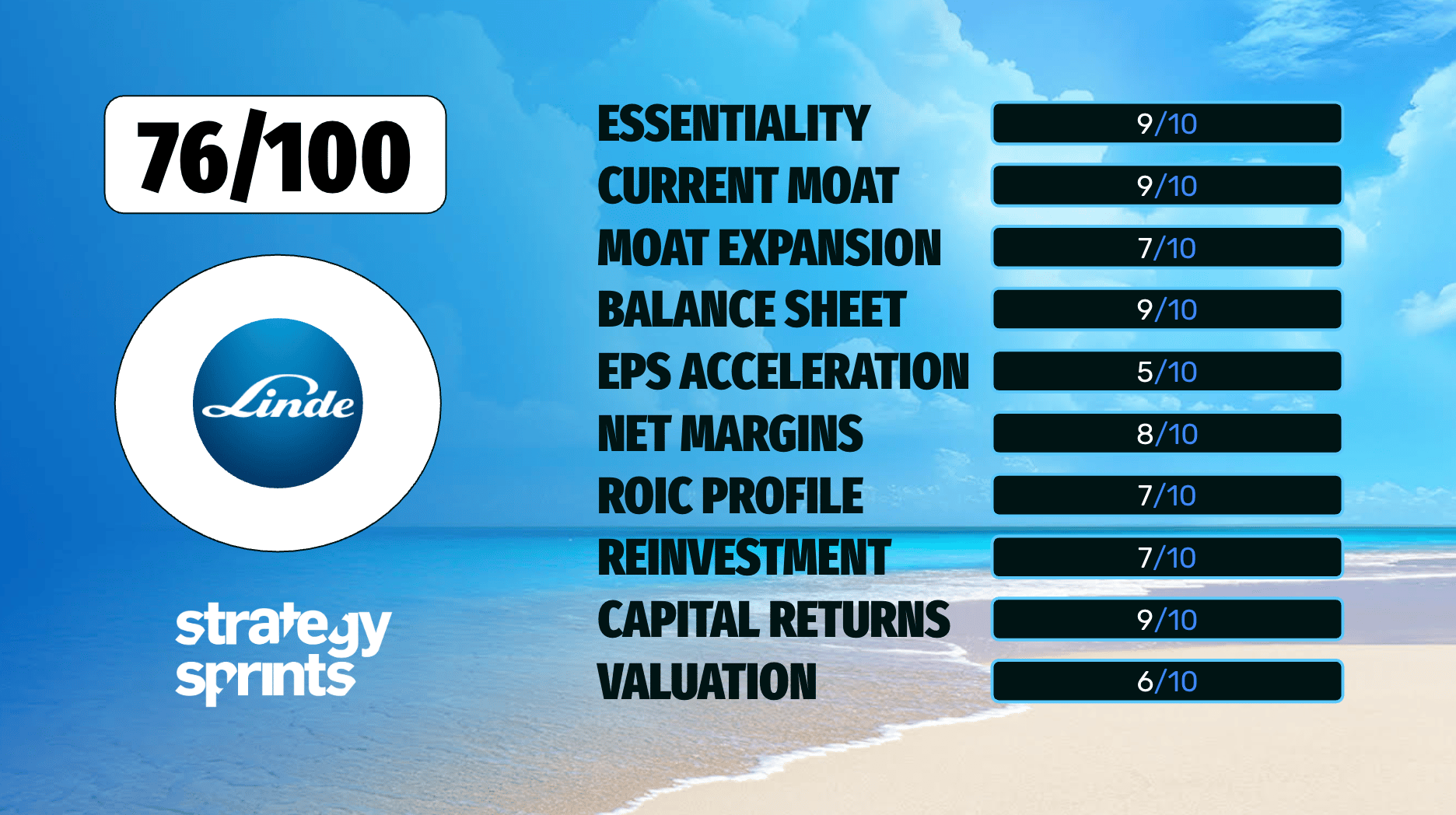

# | Criteria | Rating | Notes |

|---|---|---|---|

1 | Essential or Nice-to-Have? | 9/10 | Mission-critical across healthcare, semiconductors, steel. Customers cannot operate without industrial gases. |

2 | Current Moats | 9/10 | 15-20 year take-or-pay contracts, pipeline infrastructure, oligopolistic market, extreme switching costs. |

3 | Moats Expanding? | 7/10 | $10.4B backlog (58% clean energy), TSMC/Samsung wins. Incremental but steady expansion. |

4 | Balance Sheet Strength | 9/10 | A/A2 rating, 1.33x net debt/EBITDA, 26-34x interest coverage. Fortress. |

5 | EPS Accelerating? | 5/10 | Decelerating to ~6% (2025). Expected re-acceleration to 9-10% in 2026-27 as backlog converts. |

6 | Net Margins Increasing? | 8/10 | 12.4% → 19.9% over three years. Seven consecutive quarters of 200+ bps expansion. |

7 | ROIC Profile | 7/10 | Adjusted ROC of 25.9% (excellent); standard ROIC ~9% near WACC due to merger goodwill. Leads peers. |

8 | Reinvestment Rate | 7/10 | CapEx/OCF rising to ~52%. $7.1B sale-of-gas backlog with 15-20 year returns. Disciplined. |

9 | Capital Return | 9/10 | $7.1B returned in 2024, 33-year dividend streak, 10.4% share reduction. Shareholder-first culture. |

10 | Valuation (Reverse DCF) | 6/10 | 27x P/E vs 38x 5-year avg. Implies 4-6% growth vs 10% expectations. Reasonable, not cheap. |

OVERALL SCORE: 76/100

Verdict: High-quality compounder at historically reasonable valuation

Linde offers what long-term investors crave: structural essentiality, durable moats, and disciplined execution. The $10.4 billion project backlog provides unusual visibility into multi-year earnings growth as AI-driven semiconductor demand and energy transition create secular tailwinds.

At 27x trailing earnings versus a 38x five-year average, the market prices mid-single digit growth while analysts project 10% annually through 2027. For investors seeking a defensive compounder with clean energy exposure and structural competitive advantages, Linde offers quality at a historically reasonable valuation—though limited near-term catalysts exist in a weak industrial environment. Sometimes the best investments are the ones that let you breathe easy. Right now it sits on my watchlist, which you can access in real-time in our community.

Would you like to stay ahead of opportunities like this? Join our community where we share real-time trade alerts and deep-dive analyses of businesses with true competitive advantages. Don't just trade the market - invest in excellence.

Want to receive our trade alerts and detailed analysis in real-time? Join our community of value investors who understand that pricing power is the ultimate competitive advantage. Receive our trade alerts on your phone? Download the app here

|