- 🐝 The Investing Show

- Posts

- INVESTOR AB

INVESTOR AB

Over 100 years of outperformance later, Sweden's industrial dynasty is still crushing it.

The Wallenbergs Want Your Money (And You Should Probably Let Them Have It)

Over 100 years of outperformance later, Sweden's industrial dynasty is still crushing it.

When you think of legendary investment dynasties, the Buffetts of Omaha likely spring to mind. But tucked away in Stockholm sits a family that's been compounding wealth since 1916—the Wallenbergs. Their flagship vehicle, Investor AB, isn't just Sweden's largest holding company; it's essentially a masterclass in patient capital wrapped in a publicly-traded shell.

For investors seeking quality compounders that don't require constant babysitting, Investor AB deserves serious attention. The company delivered a 27% total shareholder return in 2024 while the Swedish benchmark managed only 9%. Over the past 20 years, shares have compounded at approximately 15% annually, outpacing even Berkshire Hathaway during the same period.

So what makes this Scandinavian juggernaut tick, and is the valuation still attractive for long-term shareholders?

What Exactly Does Investor AB Own?

Investor AB operates through three distinct segments that create a remarkably diversified industrial portfolio.

Listed Companies forms the core, with major stakes in global champions including Atlas Copco (industrial equipment), ABB (automation and robotics), AstraZeneca (pharmaceuticals), Ericsson (telecom infrastructure), SEB (banking), and Nasdaq. These aren't passive holdings—the Wallenberg network actively shapes strategy through board representation.

Patricia Industries houses wholly-owned subsidiaries like Mölnlycke (wound care), Permobil (wheelchairs), Laborie (urology), and BraunAbility (mobility vehicles). This segment delivered 30% total returns in recent years, driven by healthcare-focused businesses with sticky customer relationships.

EQT Investments provides exposure to one of Europe's premier private equity platforms. As EQT's founding investor since 1994, Investor AB benefits from both fund appreciation and distributions.

1. Essential or Nice-to-Have?

Rating: 7/10

The portfolio leans heavily toward industrials, healthcare, and financial services—sectors that power modern economies rather than discretionary consumer spending. Companies like Atlas Copco provide compressors and vacuum systems critical to manufacturing everywhere. Mölnlycke supplies wound care products to hospitals globally. SEB facilitates Nordic banking infrastructure.

These aren't "nice-to-have" businesses during downturns. However, segments like Electrolux (appliances) and Husqvarna (outdoor equipment) do carry cyclical exposure, preventing a perfect score.

2. Current Moats?

Rating: 8/10

Investor AB possesses structural competitive advantages nearly impossible for newcomers to replicate.

The Wallenberg sphere represents over a century of cultivated industrial relationships, board influence, and institutional credibility. Portfolio companies benefit from shared expertise across sectors without direct competition among holdings. The Wallenberg Foundations fund research programs like WASP (Wallenberg AI, Autonomous Systems and Software Program), creating a proprietary pipeline of elite talent directly feeding portfolio companies.

Perhaps most critically, Investor AB operates with permanent capital—no redemptions, no forced selling. This enables patient, contrarian investing during market panics when competitors scramble for liquidity.

3. Are Moats Expanding?

Rating: 7/10

Patricia Industries continues acquiring healthcare-focused businesses with recurring revenue characteristics. The recent $2.2 billion Nova Biomedical acquisition through Advanced Instruments extends reach into laboratory diagnostics.

The listed portfolio companies—Atlas Copco, ABB—are actively embedding automation and AI into industrial infrastructure, creating data moats that software-only competitors struggle to penetrate. However, expansion remains evolutionary rather than revolutionary.

4. Balance Sheet Strength?

Rating: 9/10

This is where Investor AB truly shines. As of Q3 2025, leverage sits at just 2.6% of adjusted assets (up slightly from 1.2% at year-end 2024 due to the Nova Biomedical acquisition). Gross cash exceeds SEK 23 billion, with average debt maturity extending 9.4 years.

The company maintains AA- credit rating (Aa3 from Moody's)—fortress-level for a holding company. This conservative financing provides enormous optionality during market dislocations when stressed sellers need buyers.

5. Is EPS Accelerating?

Rating: 5/10

The holding company structure creates volatile reported earnings dependent on market valuations of holdings. Trailing twelve-month EPS sits around SEK 22.98, producing a P/E of approximately 14x.

However, underlying earnings power shows steadier growth. Patricia Industries subsidiaries grew adjusted EBITA by 9% in 2024, with Mölnlycke expanding margins while delivering 8% organic sales growth. Acceleration isn't dramatic, but the trajectory remains positive.

6. Are Net Margins Increasing?

Rating: 6/10

Reported operating margins appear extraordinary at ~80% because Investor AB primarily consolidates investment income rather than operating revenues. This metric isn't directly comparable to operating companies.

Within Patricia Industries, margin expansion is occurring—Mölnlycke gained 1 percentage point in EBITA margin during Q4 2024. Listed holdings like Atlas Copco consistently deliver industry-leading profitability. Gradual improvement, not dramatic expansion.

7. ROIC Profile?

Rating: 8/10

Reported ROIC of approximately 15.5% comfortably exceeds cost of capital. ROE runs higher at ~27% due to conservative leverage deployment.

More meaningfully, the underlying portfolio companies demonstrate capital efficiency champions. Atlas Copco generates returns far exceeding industrial peers. Mölnlycke's healthcare products business produces excellent capital returns with minimal reinvestment requirements. The Wallenberg approach prioritizes ROIC-conscious capital allocation over empire-building.

8. Reinvestment Rate?

Rating: 7/10

The reinvestment engine operates through two channels. Patricia Industries aggressively deploys capital into bolt-on acquisitions and new platform companies—approximately 30% of capital receipts over the past decade flowed here.

Listed holdings reinvest internally through their own capital allocation programs—Atlas Copco's serial acquisition strategy, for example. However, Investor AB distributes roughly 50% of capital receipts as dividends (supporting the Wallenberg Foundations), which constrains maximum compounding potential.

9. Capital Return?

Rating: 8/10

The dividend has grown at 9% annually over the past decade, with SEK 5.20 proposed for fiscal 2024 (up from SEK 4.80). Current yield approximates 1.6%—modest but consistently rising.

The Wallenberg Foundations require distributions to fund Swedish research initiatives, creating structural commitment to shareholder returns. This isn't optional dividend policy; it's institutionalized capital return discipline.

10. Valuation (Reverse DCF)?

Rating: 6/10

At current prices around SEK 330-340, shares trade at roughly 14x earnings with an adjusted NAV of SEK 336 per share. This represents a modest discount to net asset value—unusual for a premium holding company, though less dramatic than periodic discounts observed at peers.

A reverse DCF analysis suggests the market prices in mid-single-digit compounding over the next decade—conservative relative to historical performance but not unreasonable given current multiples across the listed portfolio. Fair value, not screaming bargain.

The Verdict

Investor AB won't deliver overnight riches. The Wallenbergs don't chase momentum or manufacture quarterly beats. What they provide is something increasingly rare: genuine long-term ownership in diversified, high-quality businesses managed by patient capital allocators with century-long track records.

For investors seeking compounding machines requiring minimal oversight, this Swedish stalwart belongs on the shortlist. The question isn't whether Investor AB is excellent—that's settled. The question is whether current valuation offers sufficient margin of safety for your portfolio.

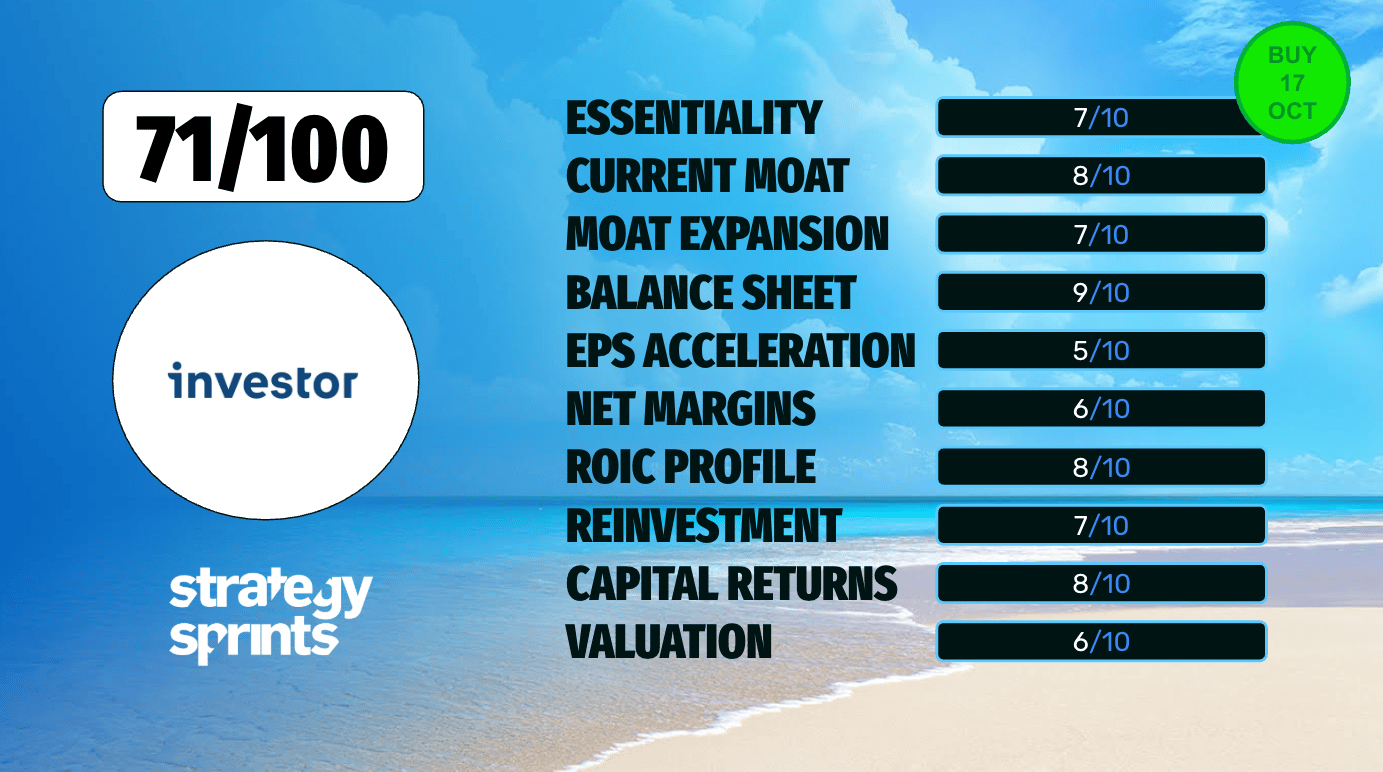

Overall Score

Category | Rating |

|---|---|

Essential or Nice-to-Have | 7 |

Current Moats | 8 |

Moats Expanding | 7 |

Balance Sheet Strength | 9 |

EPS Acceleration | 5 |

Net Margin Expansion | 6 |

ROIC Profile | 8 |

Reinvestment Rate | 7 |

Capital Return | 8 |

Valuation | 6 |

Total | 71/100 |

A solid score reflecting quality at fair prices—the sweet spot for patient compounders willing to wait while the Wallenbergs work their magic.

The business quality is undeniable. The valuation requires conviction. Right now it sits on my watchlist, which you can access in real-time in our community.

Would you like to stay ahead of opportunities like this? Join our community where we share real-time trade alerts and deep-dive analyses of businesses with true competitive advantages. Don't just trade the market - invest in excellence.

Want to receive our trade alerts and detailed analysis in real-time? Join our community of value investors who understand that pricing power is the ultimate competitive advantage. Receive our trade alerts on your phone? Download the app here

|