- 🐝 The Investing Show

- Posts

- Harvia

Harvia

The Sauna Leader Will Keep winning

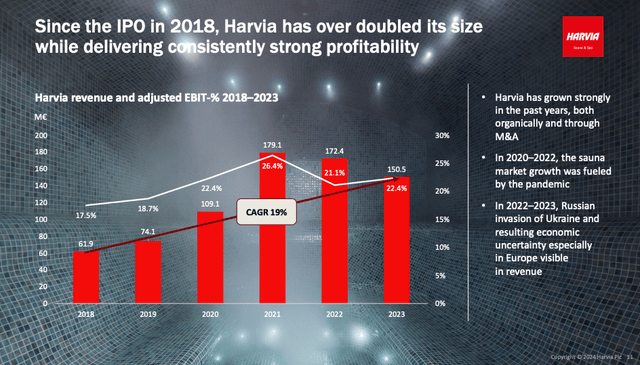

Harvia is a hidden gem. The finnish company dominates the sauna and spa market. The stock has historically outperformed, with a 62.32% gain over the past year. The wellness trend is here to stay.

Harvia Investor Day 2024

IS HARVIA VERTICALLY INTEGRATED?

Partially and strategically. The manufacturing side in fully in their control. Harvia designs, manufactures, and sells sauna heaters, sauna rooms, control units, steam generators. This integration shows in their incredible margins: 60% gross margin, 13.8% profit margins. Competitors with more fragmented supply chains have thinner margins. It sells through a mix of direct channels and a global network of distributors, dealers, and partners—over 100 countries, with 80% of sales outside Finland. While it acquired German brand EOS Saunatechnik in 2022 to bolster premium offerings and distribution, it doesn’t own the majority of its retail endpoints. Instead, it relies on B2B relationships (spa builders, architects) and B2C dealers, maintaining control over branding and product quality but not the final point of sale.

HARVIA CAN ADD COUNTRIES

Its 60% gross margin and €44.6M operating cash flow (2023) provide capital for R&D and market entry. Markets it can add:

1) North America North America’s wellness boom (spas, gyms, home fitness) offers more runway. The U.S. facility in Lewisburg, opened in 2023, supports local production, dodging tariffs and cutting shipping costs. Harvia can target coastal elites (California, New York) with luxury saunas and middle-class suburbs with affordable models. Canada’s Nordic-adjacent culture is another fit for traditional saunas.

2) Japan Harvia’s 2023 joint venture with Bergman Ltd. in Japan taps a high-potential APAC market. Japan’s onsen (hot spring) culture aligns with saunas, and its aging, health-conscious population could embrace compact, high-tech units.

3) India Untapped in Harvia’s reports, India’s wellness market is exploding. Projected at $70 billion by 2025. Urban elites in Mumbai or Bangalore could buy personal saunas, while resorts in Kerala (ayurvedic hubs) might install commercial units. Low-cost production in Romania could make this viable.

Harvia Investor Day 2024

CAN IT ALSO ADD PRODUCTS?

Smart Sauna Tech: Harvia can leverage its control unit expertise to integrate IoT features (app connectivity, AI temperature adjustment). Its German facility, with EOS’s high-tech focus, could prototype these, building on current digital offerings.

Cold Therapy Units: It can use its wood and metalworking capabilities to design compact ice baths or cryotherapy pods. Pairing these with saunas taps into its modular spa know-how.

Sustainable Heaters: Retrofit Finnish production lines to roll out solar-powered or ultra-efficient infrared units, aligning with its 2023 sustainability push.

Portable Saunas: Adapt low-cost Romanian or Chinese manufacturing to create foldable, consumer-friendly designs, using existing heater tech scaled down.

Harvia Investor Day 2024

Evidence It’s Already Happening

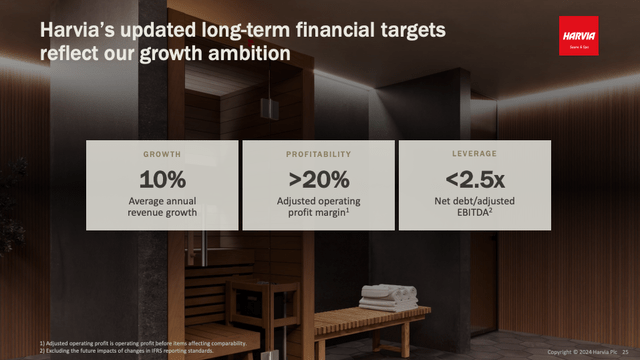

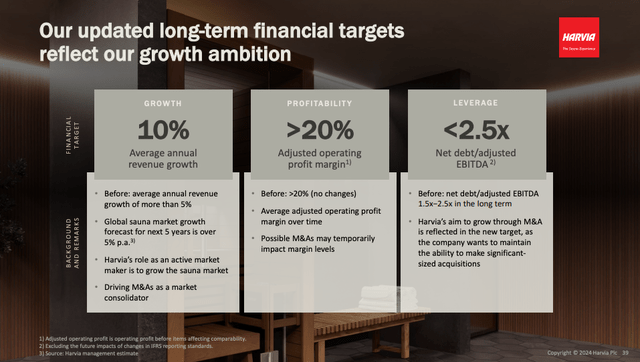

Harvia’s 2024 strategy update targets 10% annual revenue growth, partly through “new product categories.” Its Q3 2024 earnings beat (0.30 EUR vs. 0.31 EUR expected) and 16.38% revenue jump reflect momentum, likely including early wins from new offerings like enhanced EOS lines or digital upgrades. Is Harvia a buy? Given its track record (400% 5-year return), it’s a safe bet. Markets are not aware of Harvia yet.

A quick DCF suggests it’s undervalued (€71.43 vs. €44.55, a 60% discount)

Full disclosure: I own Harvia shares. Many of you asked what’s on my watchlist. Access my complete watchlist in our community.

Would you like to stay ahead of opportunities like this? Join our community where we share real-time trade alerts and deep-dive analyses of businesses with true competitive advantages. Don't just trade the market - invest in excellence.

Want to receive our trade alerts and detailed analysis in real-time? Join our community of value investors who understand that pricing power is the ultimate competitive advantage. Receive our trade alerts on your phone? Download the app here