- 🐝 The Investing Show

- Posts

- GXO Logistics

GXO Logistics

The AI company you never heard about

Why GXO Is a Buy Today

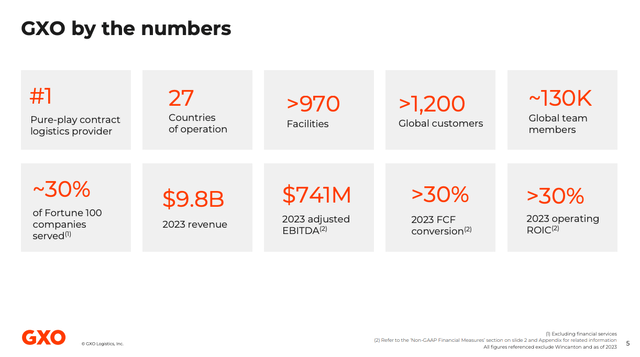

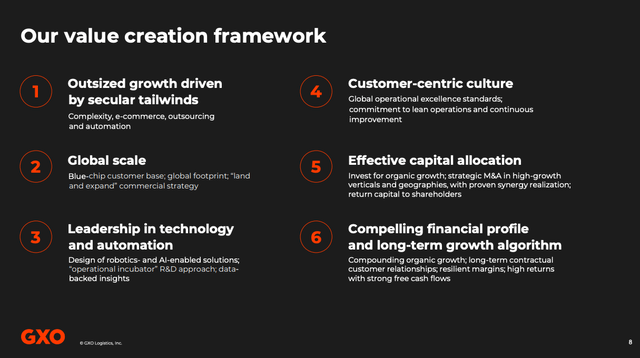

The current CEO of GXO Logistics is retiring. Finding a new one might take until summer. Meanwhile this solid logistics company is dirt cheap and ready to benefit from AI and automation. GXO uses advanced automation in over 30% of its warehouses, way above the industry average of 8%. They've made smart acquisitions and have a $2.4 billion sales pipeline lined up. Their customers are top notch, from Versace to Oracle. Right now investors are selling. Interpreting the temporary headwinds (U.K. softness, FX, and leadership transition) as structural issues. So is this a good time to buy in?

GXO Investor Presentation NOV 2024

The AI Company You've Never Heard About

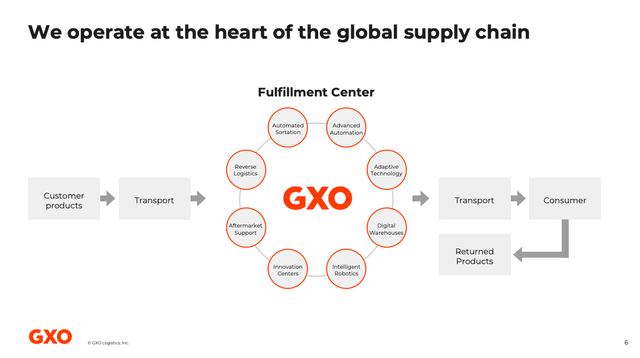

GXO Logistics was split off from XPO Logistics in August 2021 to focus just on contract logistics. From day one, they were all about automation and AI. The company works globally, handling warehousing, distribution, order fulfillment, e-commerce, returns. What makes them different from old-school logistics companies is how they use advanced technology like automation and AI to make supply chains better. With this low sentiment, and a proven capacity to win, GXO could surprise to the upside.

GXO Investor Presentation NOV 2024

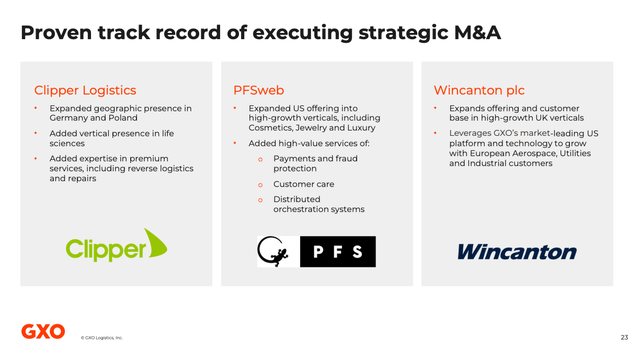

In 2024, they bought Wincanton, which expanded their presence in Europe and got them into industrial and aerospace markets. This move alone could boost their earnings per share by double digits once everything's integrated. The company signed contracts worth over $1 billion in annual revenue so far this year, with potential deals worth $2.4 billion in the pipeline, showing strong demand.

GXO Investor Presentation NOV 2024

Financial Headwinds

GXO reported a record $3.3 billion in revenue for Q4 2024, up 27% from Q4 2023.

For the full year 2024, revenue reached $12.1 billion, a 24% increase.

Net income for Q4 2024 was $61 million, slightly down from $73 million in Q4 2023, due to higher costs.

Adjusted EBITDA for Q4 2024 hit $211 million, and full-year adjusted EBITDA grew to $805 million.

Are The Headwinds Temporary or Structural?

Temporary Case: Most headwinds (U.K. softness, FX, and leadership transition) are tied to specific events or cycles. The company’s core strengths remain intact: $12.1 billion in 2024 revenue (24% growth), $805 million in adjusted EBITDA (10% growth), and a $1 billion new business pipeline.

Structural Case: If economic weakness persists or automation fails to offset cost pressures, headwinds could harden. However, its diversified client base (no customer >4% of revenue), long-term contracts (77% of $3.9 billion obligations over three years), and outsourcing trend (40% of 2024 wins) can buffer against structural decay.

GXO Investor Presentation NOV 2024

Undervalued Compared To Peers

As of mid-February 2025, GXO trades around $39.40, reflecting market worries about the CEO transition. The trailing P/E is 48.90, which is high because earnings are down, but the forward P/E of 13.90 looks more reasonable based on expected 2025 earnings recovery. At 13.23, GXO's EV/EBITDA is below the logistics industry average (about 15x), suggesting it's undervalued.

Compared to similar companies like C.H. Robinson or XPO Logistics, GXO's focus on contract logistics and technology offers better growth potential at a relatively attractive price.

GXO Investor Presentation NOV 2024

To Buy or Not?

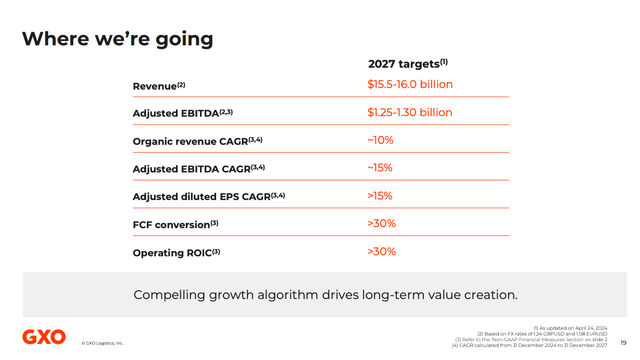

GXO’s headwinds are predominantly temporary. The Q1 2025 EBITDA hit and U.K. slowdown are short-term, cyclical issues, while FX and leadership changes are manageable externalities. Structural risks (cyclicality, competition) exist but are mitigated by GXO’s scale, tech leadership, and contract stability. The company’s 2025 guidance (3-6% organic growth, $2.40-$2.60 adjusted EPS) reflects resilience, despite a 15% stock drop post-earnings (February 13th, 2025). Absent a prolonged global recession or strategic misstep, these challenges should fade by mid-2025 as new wins and acquisitions kick in.

GXO moved from watchlist to ownership. Access my complete watchlist in our community.

Would you like to stay ahead of opportunities like this? Join our community where we share real-time trade alerts and deep-dive analyses of businesses with true competitive advantages. Don't just trade the market - invest in excellence.

Want to receive our trade alerts and detailed analysis in real-time? Join our community of value investors who understand that pricing power is the ultimate competitive advantage. Receive our trade alerts on your phone? Download the app here