- 🐝 The Investing Show

- Posts

- DLO

DLO

What Happens When Starlinks Tries To Enter A New Country?

DLocal: The Emerging Markets Toll Booth Where Even Your Pesos Pay Tribute

How a Uruguayan Fintech Became the Gateway to 4 Trillion Wallets

Current Price: $14.33 | Ticker: DLO (NASDAQ) | Market Cap: ~$4.2B

What Happens When Stripe Can't Figure Out Brazilian Boletos?

When a Silicon Valley giant wants to collect payment from a gamer in Nigeria, a streaming subscriber in Argentina, or a ride-share driver in Mexico, they face a labyrinth of local regulations, exotic currencies, and over 900 different payment methods. Enter DLocal, the Uruguayan fintech that has built the definitive "One dLocal" platform—a single API that connects global enterprises to billions of consumers across 40+ emerging markets in Latin America, Africa, the Middle East, and Asia.

Founded in 2016 and led by former MercadoLibre CFO Pedro Arnt, DLocal has quietly become the plumbing behind digital commerce in regions where 85% of the world's population resides. Five of the six largest tech companies by market cap now rely on DLocal to process cross-border payments in markets too complex for Stripe, Adyen, or PayPal to crack efficiently.

The Business Model: A Toll Booth With FX Superpowers

DLocal operates on a deceptively simple model: it charges merchants a small fee (~1.2% take rate) on every transaction processed through its platform—both "pay-ins" (customer payments) and "pay-outs" (merchant disbursements). The company also captures FX spreads when converting between currencies, a meaningful profit center in volatile emerging markets.

What makes DLocal special is the infrastructure moat. Building local banking relationships, securing regulatory licenses, and integrating fragmented payment methods (from Brazil's Pix to Kenya's M-Pesa) takes years. Global giants would rather pay DLocal than replicate this work in 40 countries. The result? A 144% net revenue retention rate—merchants stay and grow their volumes dramatically.

The Numbers Don't Lie: Q3 2025 Was a Masterclass

DLocal's most recent quarter (Q3 2025) delivered records across the board. Total Payment Volume hit $10.4 billion (+59% YoY), revenue surged to $282.5 million (+52% YoY), and gross profit crossed $100 million for the first time. Net income exploded 93% to $51.8 million. For 2025, management guides 40-50% TPV growth and 30-40% revenue growth.

The balance sheet is pristine: zero debt and over $600 million in cash. Free cash flow generation remains robust at $38 million quarterly, and the company even declared an extraordinary dividend of $0.525/share earlier this year. This is a growth company that prints cash.

The Investment Scorecard: Dissecting DLocal's Quality

1. Essential or Nice-to-Have? Score: 7/10

Payment processing is essential infrastructure—but DLocal's specific services become mission-critical only when merchants want emerging market exposure. While global e-commerce growth makes this increasingly essential, the company still serves a subset of enterprises rather than universal consumer need. Rising digital penetration in LatAm and Africa tilts this toward essential.

2. Current Moats: Score: 7/10

DLocal possesses genuine competitive advantages: regulatory licenses in 30+ jurisdictions (including UK FCA), network effects from 900+ integrated payment methods, and high switching costs for enterprise clients. The recent AZA Finance acquisition strengthens its African moat. However, Adyen and Stripe are investing heavily in emerging markets, and take rate compression signals pricing pressure. The moat is real but narrower than a Visa or Mastercard.

3. Are Moats Expanding? Score: 6/10

DLocal is actively widening its moat through product innovation (BNPL Fuse, stablecoin settlements with Circle/BVNK), geographic expansion (29 countries now), and AI-driven operational efficiency. Customer concentration has improved (top 10 = 51% of revenue, down from 62%). However, take rate compression and competitive encroachment represent headwinds. Moat is stable but not dramatically expanding.

4. Balance Sheet Strength: Score: 9/10

Zero debt. Over $600 million in cash. Consistent free cash flow generation with 85%+ conversion. This is a fortress balance sheet that provides strategic flexibility for M&A, buybacks, and weathering emerging market volatility. The only missing point: no history of significant capital returns to shareholders until recently.

5. Is EPS Accelerating? Score: 6/10

EPS trajectory has been volatile. After hitting $0.51 in 2023, FY2024 EPS dropped to $0.42 amid margin compression and investments. However, Q3 2025 net income grew 93% YoY, suggesting a strong rebound. TTM EPS now sits around $0.52-0.56. Acceleration is present but inconsistent due to currency volatility and mix shifts.

6. Net Margins Expanding? Score: 5/10

Net margins have compressed from ~19% to ~17% over the past year. EBITDA margins have moderated from 30% to 25% as DLocal invests in engineering talent, licenses, and geographic expansion. Management expects modest margin expansion as AI automation and scale economies kick in, but this remains a watch item.

7. ROIC Profile: Score: 8/10

DLocal's asset-light model generates exceptional returns on capital. With minimal capex requirements and no inventory, the business consistently produces ROIC in the mid-30% range and ROE of 32.6%. This capital efficiency is comparable to elite software businesses and validates the platform business model. Few payment processors match this profile.

8. Reinvestment Rate: Score: 7/10

DLocal reinvests aggressively through engineering talent, license acquisitions, and geographic expansion rather than heavy capex. The company added 9 new licenses in 2024 alone. The AZA Finance acquisition signals willingness to deploy capital for inorganic growth. Reinvestment runway remains substantial given emerging market TAM of $2+ trillion.

9. Capital Return: Score: 6/10

DLocal has historically prioritized growth over returns, but 2025 marked a shift: an extraordinary $150 million dividend ($0.525/share) and share buyback programs. The company now balances growth investment with shareholder returns. This is appropriate for a high-growth business but limits the score versus serial compounders.

10. Valuation (Reverse DCF): Score: 7/10

At $14.33 with ~$0.56 TTM EPS, DLocal trades at roughly ~25x earnings—a discount to Adyen (22-25x EBITDA, slower growth) and PayPal (13-15x, mature). The reverse DCF implies the market embeds ~15-20% annual growth for the next decade, which is below management guidance of 30-40%+ revenue growth. Morningstar pegs fair value at $34.89, suggesting significant undervaluation. The discount reflects emerging market risk premiums, but for believers in the secular digitization thesis, the margin of safety appears reasonable.

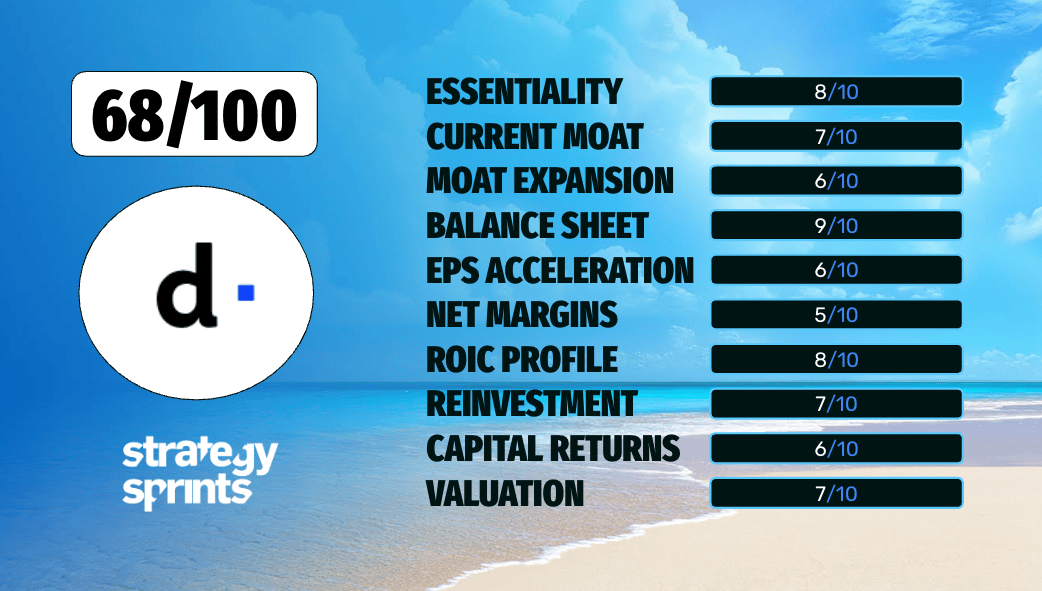

Scoring Summary

Criterion | Score |

|---|---|

1. Essential or Nice-to-Have | 7/10 |

2. Current Moats | 7/10 |

3. Moat Expansion | 6/10 |

4. Balance Sheet Strength | 9/10 |

5. EPS Acceleration | 6/10 |

6. Net Margin Expansion | 5/10 |

7. ROIC Profile | 8/10 |

8. Reinvestment Rate | 7/10 |

9. Capital Return | 6/10 |

10. Valuation | 7/10 |

OVERALL SCORE | 68/100 |

The Bottom Line: A Quality Compounder With Frontier Risk

DLocal scores 68/100—a solid "above average" rating that reflects genuine quality paired with meaningful risks. The business model is elegant, the balance sheet is impeccable, and the growth trajectory remains impressive. ROIC in the mid-30s places this among the most capital-efficient payment processors globally.

The key concerns are margin compression, currency volatility, and competitive encroachment from well-capitalized rivals. DLocal is not yet a wide-moat compounder like Visa—but it may be the Visa of the Global South in the making.

For investors comfortable with emerging market volatility and seeking exposure to digital commerce in the world's fastest-growing economies, DLocal offers a rare combination: high growth, strong cash flow, and reasonable valuation. At ~25x earnings with 40%+ TPV growth guidance, the risk/reward skews favorably for patient capital with a 5-10 year horizon.

As emerging markets digitize, DLocal stands at the toll booth—collecting its tribute one transaction at a time.

We own shares of DLO, and plan to add to positions on our watchlist, which you can access in real-time in our community.

Would you like to stay ahead of opportunities like this? Join our community where we share real-time trade alerts and deep-dive analyses of businesses with true competitive advantages. Don't just trade the market - invest in excellence.

Want to receive our trade alerts and detailed analysis in real-time? Join our community of value investors who understand that pricing power is the ultimate competitive advantage. Receive our trade alerts on your phone? Download the app here

|