- 🐝 The Investing Show

- Posts

- CER

CER

Founder-led, mission-critical software, exceptional margins, fortress balance sheet, outstanding ROIC, and sticky customer relationships.

Cerillion: The Telecom Billing Company That Won't Stop Dialing Up Returns

When your customers literally can't afford to switch off your software, you've found the ultimate sticky business.

Cerillion Plc is a UK-based enterprise software company that provides mission-critical billing, charging, and CRM solutions to telecommunications operators worldwide. Founded in 1999 via a management buyout from Logica, and led by founder-CEO Louis Hall for over 25 years, this AIM-listed company has quietly compounded its way to delivering some of the most impressive financial metrics you'll find in European small-caps.

The company's software sits at the heart of telecom operations—it's what allows operators to bill customers, manage subscriptions, handle payments, and provision services. Without BSS/OSS (Business Support Systems/Operations Support Systems), a telecom literally cannot charge for its services. The company serves approximately 70 customer installations across 45 countries, including major names like Virgin Media, MTN, KDDI, Orange, and Cox Communications.

www.strategysprints.com

The fiscal year 2025 results (ending September 30, 2025) showed the company firing on all cylinders: revenue up 4% to £45.4m, adjusted EBITDA margins expanding to a remarkable 50.9%, net cash growing 15% to £34.4m, and new orders surging 25% to a record £47.6m. Most impressively, the back-order book—essentially contracted future revenue—hit £56.9m, up 21% year-over-year.

Is It Essential or Nice-to-Have?

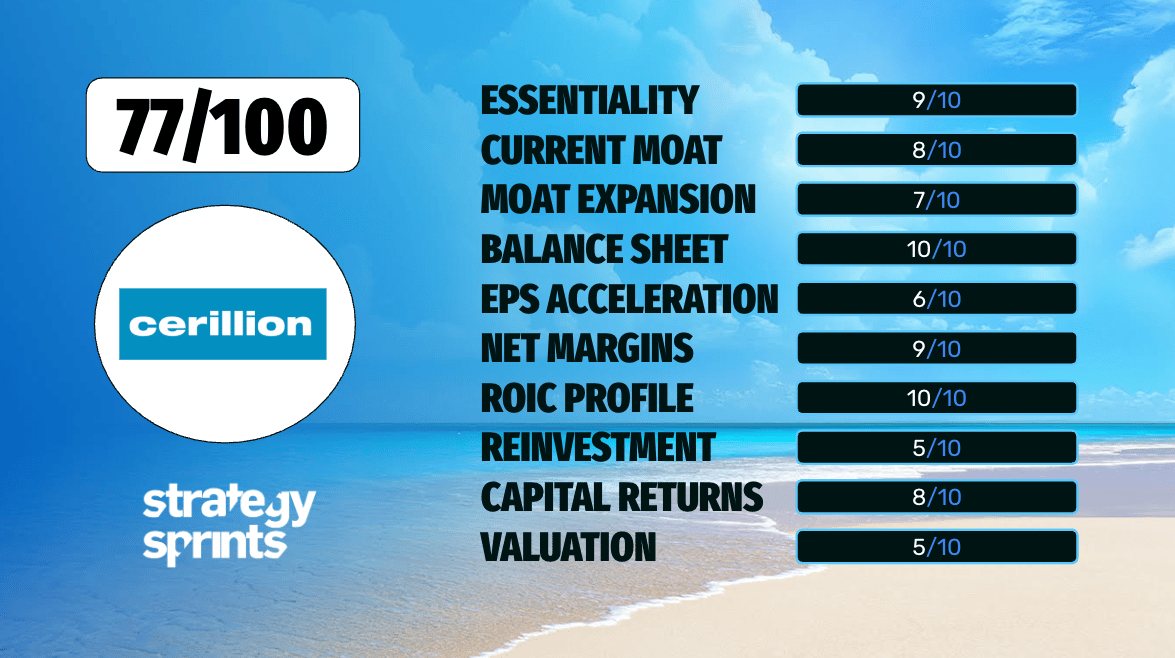

Rating: 9/10

BSS/OSS software is the operational backbone of any telecom company. Without it, operators cannot bill customers, provision services, or manage their subscriber base. This isn't a "nice productivity tool"—it's genuinely mission-critical infrastructure. Cerillion's customers include tier-1 operators who process millions of transactions daily. The software handles everything from real-time charging to fraud detection to revenue recognition. A telecom switching off Cerillion would be like an airline shutting down its reservation system mid-flight.

Current Moats

Rating: 8/10

Cerillion benefits from multiple reinforcing moats. High switching costs dominate—83% of customers have been with the company for more than 5 years, and 93% of revenue comes from existing customers. BSS transformation projects typically span 2-3 years with deep integration into a telecom's entire operational stack. The reputational and operational risk of switching is enormous.

Barriers to entry are substantial: the company notes that building a competitive BSS/OSS suite requires 20+ years of R&D investment, specialized domain expertise that's extremely scarce, and a track record of proven deployments that new entrants simply cannot replicate. Additionally, Cerillion has been recognized by Gartner, IDC, Frost & Sullivan, and other independent research firms—credibility that takes decades to build.

Are Moats Expanding?

Rating: 7/10

The company is actively investing to widen its competitive position. R&D investment jumped over 30% year-over-year (17,500 man-days in FY25 vs. 12,795 in FY24). The recent Cerillion 25.2 release focused heavily on AI integration, including Model Context Protocol servers and AI agents—positioning the platform for the next wave of telecom automation.

The sales pipeline continues expanding with weighted prospects up from £26m in 2021 to £65m in 2025. New customer wins like Ucom in Armenia demonstrate geographic expansion. The key question is whether AI becomes a moat-enhancer or an eventual threat—management appears to be betting on the former by embedding AI deeply into their platform.

Balance Sheet Strength

Rating: 10/10

This is a fortress balance sheet by any measure. The company holds £34.4m in net cash with zero debt—representing nearly 60% of net assets. Net assets grew 23% year-over-year to £59.6m. Free cash flow generation is strong and consistent at £10.9m for FY25. The company could theoretically buy back 8% of its market cap annually from cash flow alone while still growing the cash pile. This financial strength supports the strategy of pursuing larger enterprise customers who demand vendor stability.

Is EPS Accelerating?

Rating: 6/10

Adjusted EPS grew from 52.2p to 56.5p—an 8.2% increase—which is solid but represents a slight deceleration from prior years. The five-year EPS trajectory has been consistently strong, but the rate of growth is normalizing as the business scales. The 25% surge in new orders and 21% back-order book growth suggest EPS acceleration could resume in FY26-27 as these orders convert to revenue.

Are Net Margins Increasing?

Rating: 9/10

Yes, and impressively so. Adjusted EBITDA margins expanded from 47.4% to 50.9%—crossing the 50% threshold for the first time. Gross margins also improved from 80.5% to 81.5%. This margin expansion came from favorable foreign exchange, higher day rates on implementation projects, and favorable license mix. For a software company generating over 50% EBITDA margins while still growing, the operating leverage is exceptional.

ROIC Profile

Rating: 10/10

This is where Cerillion truly shines. With operating profit of £20.6m and invested capital (excluding excess cash) of approximately £25m, the company generates an ROIC north of 60%. Even using total equity including excess cash, returns on equity exceed 28%. The asset-light software model combined with high customer retention creates exceptional capital efficiency. There's no goodwill bloat, minimal capex requirements, and working capital moves favorably with growth.

Reinvestment Rate

Rating: 5/10

Here's the trade-off with capital-light businesses. Cerillion capitalizes only £1.9m annually in development costs. Total capex including intangibles runs around £2.3m against £10.9m of free cash flow—a reinvestment rate of roughly 21%. The company is expanding sales teams in the USA, Europe, and Asia, but organic reinvestment opportunities are inherently limited in a mature, specialized enterprise software niche. Management has signaled openness to strategic acquisitions, but none have materialized post-IPO.

Capital Return

Rating: 8/10

Cerillion follows a progressive dividend policy targeting one-third to one-half of free cash flows. The FY25 dividend of 15.4p represents a 17% increase year-over-year and implies a yield of approximately 1.1% at current prices. Dividend coverage stands at 3.7x adjusted EPS. The company also purchased £1.3m in treasury stock during the year. With £34.4m in cash generating minimal returns, there's room for more aggressive capital returns, but management prioritizes balance sheet strength for larger customer pursuits.

Valuation

Rating: 5/10

At 1372p per share, Cerillion trades at approximately 24x adjusted earnings and 16x EV/EBITDA. For a 50%+ margin business growing high-single-digits organically with net cash, this isn't cheap—but it's not egregiously expensive either.

A reverse DCF analysis suggests the market is pricing in roughly 10-12% annual cash flow growth for the next decade. Historically, the company has compounded revenue at 17% and EBITDA at 32% over five years. If anything close to that continues, current valuations could prove conservative. However, the business is clearly maturing, and growth rates are normalizing. Fair value appears roughly aligned with current prices—neither a screaming buy nor a clear sell.

Overall Score: 77/100

Cerillion represents a textbook quality compounder: founder-led, mission-critical software, exceptional margins, fortress balance sheet, outstanding ROIC, and sticky customer relationships. The main limitations are modest reinvestment opportunities, geographic concentration in Europe (77% of revenue), and a valuation that already reflects much of the quality premium.

For long-term investors seeking dependable compounding in an overlooked corner of the market, Cerillion deserves serious attention. The record back-order book and expanding pipeline suggest the next few years could exceed current expectations—making this AIM-listed gem worth keeping on your watchlist. The business quality is undeniable. The valuation requires conviction. Right now it sits on my watchlist, which you can access in real-time in our community.

Would you like to stay ahead of opportunities like this? Join our community where we share real-time trade alerts and deep-dive analyses of businesses with true competitive advantages. Don't just trade the market - invest in excellence.

Want to receive our trade alerts and detailed analysis in real-time? Join our community of value investors who understand that pricing power is the ultimate competitive advantage. Receive our trade alerts on your phone? Download the app here

|