- 🐝 The Investing Show

- Posts

- ART

ART

Earnings Acceleration Meets Electrifying Returns

Arteche: Earnings Acceleration Meets Electrifying Returns

The 78-year-old Spanish grid infrastructure player might be the most boring way to profit from the AI energy boom. And that's exactly why it's interesting.

The Invisible Giant Hiding in Plain Sight

Every time you flip a switch, there's a good chance Arteche Lantegi Elkartea had something to do with it. Founded in 1946 in Spain's Basque Country, this family-backed company has quietly become the world's #2 player in high voltage instrument transformers and holds a commanding ~80% market share in medium voltage transformers across key European markets.

Arteche operates across three business segments: Measurement & Monitoring (72% of revenue), T&D Grid Automation (10%), and Network Reliability (18%). Their products—voltage transformers, auxiliary relays, reclosers, and substation automation systems—aren't glamorous. But they're absolutely essential. Without them, electricity grids simply don't function.

The company covers the entire electricity value chain from generation to distribution, including the railway sector. They've manufactured over 500,000 auxiliary relays annually and serve customers in the USA, Spain, Mexico, Australia, Canada, China, and beyond. The management team combines professional leadership with family ownership commitment—a structure that tends to favor long-term thinking over quarterly earnings theatrics.

Why Utilities Can't Live Without This Stuff

Grid infrastructure spending isn't optional. Three massive tailwinds are converging to make Arteche's products mission-critical rather than discretionary:

Decarbonization is forcing a complete overhaul of electricity infrastructure. The Paris Agreement and related policies are driving unprecedented demand for renewable integration equipment. Solar and wind farms don't plug into 1970s-era grids without significant upgrades.

Digitalization is transforming dumb grids into smart ones. Arteche's digital substations, protection systems, and automation solutions are exactly what utilities need as they modernize aging infrastructure.

Decentralization adds complexity everywhere. When electricity flows in multiple directions—from rooftop solar panels, electric vehicles, and battery storage—you need sophisticated measurement and control systems. This is Arteche's bread and butter.

Management projects global energy demand will double from 2020 to 2050 due to electrification and new grid-connected devices. Data centers for AI workloads are accelerating this timeline considerably.

The Numbers Tell a Compelling Story

The financials show a business hitting its stride. Revenue grew at a 14% CAGR from 2020 to 2024, reaching €447.4 million in FY2024 (up 11.5% year-over-year). EBITDA expanded even faster at a 15% CAGR, hitting €51.6 million with margins expanding 140 basis points to 11.5%.

The first half of 2025 shows acceleration, not deceleration. Revenue jumped 13.9% year-over-year to €256.2 million. EBITDA surged an extraordinary 55.6% to €38.3 million, with margins expanding 390 basis points to 15.0%. Net profit exploded 168.5% to €19.9 million.

Order intake remains robust at €302.2 million in H1 2025 (up 6.2%), providing solid visibility into future quarters. The company beat its own 2024 guidance across all metrics and is targeting €500-515 million in revenue with 14.5-15.0% EBITDA margins for 2025.

|

Fortress Balance Sheet, Intelligent Capital Allocation

Arteche has deleveraged aggressively, reducing Net Debt/EBITDA from 2.2x in 2020 to just 0.5x at year-end 2024. Free cash flow reached €24.9 million in 2024, representing an impressive 48% conversion of EBITDA. The company maintains €29 million in immediately available long-term resources with an average debt maturity of ~4.6 years.

Capital allocation follows a disciplined playbook. R&D investment exceeds 3.5% of revenue—unusual for an industrial company this size. The M&A strategy focuses on four pillars: geographic expansion (targeting US and APAC), new solutions, new technologies, and new segments. Recent acquisitions include RTR Energy (capacitors and power quality) and minority stake in Teraloop (flywheel technology for energy storage).

The return profile is attractive: ROIC stands at approximately 16.4%, well above cost of capital and expanding as margins improve. This isn't a capital-intensive commodity business—it's a specialty manufacturing company with real barriers to entry.

Moats That Actually Work

Arteche occupies a fascinating competitive position: a hybrid between Tier I giants (Siemens, Hitachi, ABB, GE) and smaller niche players. This positioning creates multiple moats.

Technical certification barriers are substantial. High voltage equipment requires rigorous testing and certification—Arteche operates its own ultra-high voltage laboratory. Customers face real switching costs since utility equipment must integrate seamlessly with existing infrastructure.

Relationship stickiness matters enormously. When a transformer fails, utilities don't shop around—they call their existing supplier. The 75+ years of customer relationships and global service network create powerful recurring revenue dynamics.

Niche dominance provides pricing power. Being #1 or #2 in specific product categories across multiple geographies means competitors can't easily undercut pricing without sacrificing margin on their own core products.

Valuation: Expensive or Just Getting Started?

At €22.6 per share, Arteche trades at roughly 38x trailing earnings and 29x forward estimates. The EV/EBITDA multiple sits around 24x. These aren't cheap multiples by traditional industrial standards.

However, reverse DCF analysis suggests the market is pricing in approximately 12-15% annual earnings growth for the next five years—which aligns reasonably with management guidance and sector trends. Given the structural tailwinds in grid modernization, this isn't obviously unrealistic.

The stock has risen 265% over the past 52 weeks, from €6.40 to its current level. This reflects a significant re-rating as the market recognizes the quality of the business. The key question is whether margins can continue expanding and whether order momentum sustains through potential economic softness.

Let’s Score ART

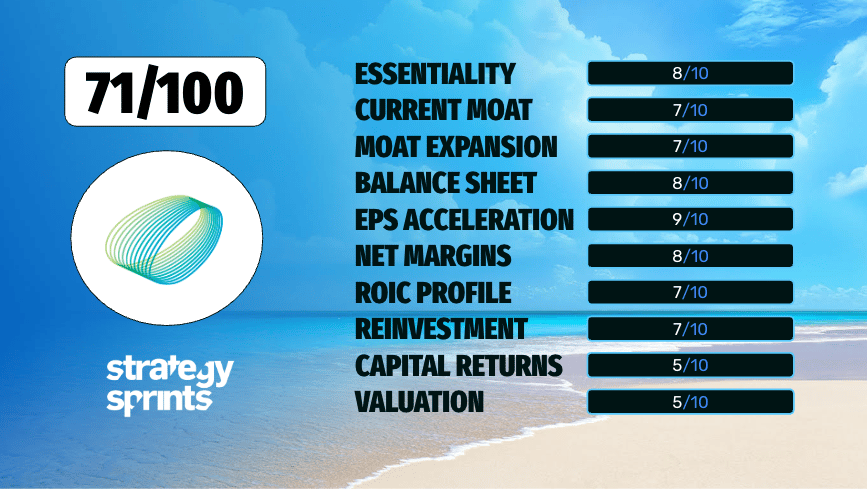

1. Essential or Nice-to-Have? Rating: 8/10 Grid infrastructure is non-discretionary. Utilities can't delay upgrades indefinitely without risking blackouts. However, project timing can shift, creating some cyclicality.

2. Current Moats? Rating: 7/10 Strong niche positions, certification barriers, and customer relationships. Not as wide as pure software moats, but durable in this industrial context.

3. Moats Expanding? Rating: 7/10 Growing geographic footprint, digital product extensions, and energy storage entry suggest moat widening. The Hitachi joint venture validates technical capabilities.

4. Balance Sheet Strength? Rating: 8/10 Net debt/EBITDA of 0.5x, strong free cash flow conversion, and diversified funding sources. A genuine position of strength.

5. EPS Acceleration? Rating: 9/10 H1 2025 net profit up 168.5% YoY with margin expansion across all metrics. This is genuine operating leverage, not financial engineering.

6. Net Margins Increasing? Rating: 8/10 EBITDA margins improved from 9.3% to 15.0% over two years. Direct margins up 340 bps. The trajectory is clear and substantial.

7. ROIC Profile? Rating: 7/10 ROIC around 16.4% and expanding. Solid, though not exceptional by software standards. Very good for an industrial manufacturer.

8. Reinvestment Rate? Rating: 7/10 Healthy capex and R&D spending (>3.5% of revenue), active M&A pipeline. Management demonstrates willingness to invest for growth.

9. Capital Return? Rating: 5/10 Modest dividend yield (~0.7%). Management prioritizes reinvestment and balance sheet strength over aggressive payouts—appropriate given growth opportunities.

10. Valuation? Rating: 5/10 Not cheap at ~38x trailing earnings. Premium reflects quality and growth, but leaves less margin of safety. Fair value, perhaps slightly expensive.

ART Overall Score: 71/100

Arteche represents a high-quality industrial compounder benefiting from structural tailwinds in grid modernization. The business has real moats, improving economics, and a conservative balance sheet managed by an owner-operator mentality. The valuation reflects much of the good news, meaning investors need to believe the margin expansion runway extends further. For patient long-term investors seeking exposure to the electrification megatrend without buying momentum-driven AI names, Arteche deserves serious consideration. The business quality is undeniable. The valuation requires conviction. Right now it sits on my watchlist, which you can access in real-time in our community.

Would you like to stay ahead of opportunities like this? Join our community where we share real-time trade alerts and deep-dive analyses of businesses with true competitive advantages. Don't just trade the market - invest in excellence.

Want to receive our trade alerts and detailed analysis in real-time? Join our community of value investors who understand that pricing power is the ultimate competitive advantage. Receive our trade alerts on your phone? Download the app here

|